Published: 26 June 2020

Households’ net financial assets decreased strongly in the first quarter of 2020

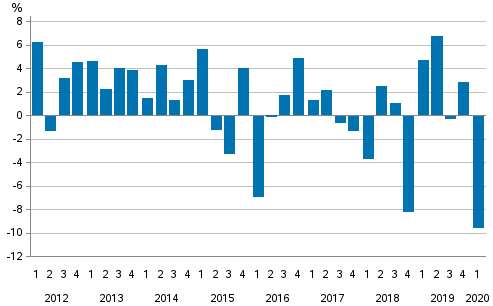

Households’ financial assets declined by EUR 14.5 billion during the first quarter of 2020 falling to EUR 319.4 billion. In turn, households’ debts contracted by EUR 0.4 billion during the first quarter of 2020 decreasing to EUR 184.1 billion. As a result of these changes, households' net financial assets decreased by EUR 14.2 billion to EUR 135.3 billion. Net financial assets refer to the difference between financial assets and liabilities. These data derive from Statistics Finland’s financial accounts statistics.

Change from the previous quarter in households’ net financial assets

Holding losses decreased strongly households’ financial assets

Holding losses pushed the value of households’ financial assets to a steep decline, which was caused by exceptional uncertainty in the share and other securities markets and decreases in the value of investments caused by it. In the first quarter of 2020, households increased their net investments in financial assets by EUR 0.8 billion. Households' investments in deposits and quoted shares increased and investments in debt securities and investment funds decreased.

Households’ indebtedness ratio rose slightly

Households' loan debts increased by EUR 1.7 billion to EUR 158.7 billion. At the same time, households’ disposable income also grew. Households’ indebtedness ratio grew by 0.3 percentage points from the previous quarter to 129.4 per cent. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters. The indebtedness ratio is calculated from figures non-adjusted for seasonal variation.

Non-financial corporations’ debt financing grew

In the first quarter, non-financial corporations' debt financing grew from EUR 9.1 billion to EUR 257.9 billion. Non-financial corporations’ financing in the form of debt securities grew by EUR 1.7 billion and rose to EUR 32.9 billion, while non-financial corporations' loan debts went up by EUR 7.4 billion rising to EUR 225.0 billion. Debt financing refers to the total of loan debts and financing in the form of debt securities.

Source: Financial accounts, Statistics Finland

Inquiries: Timo Ristimäki 029 551 2324, Jose Lahtinen 029 551 3776, rahoitus.tilinpito@stat.fi

Head of Department in charge: Jan Nokkala

Publication in pdf-format (262.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

- Revisions in these statistics

-

- Revisions in these statistics (26.6.2020)

Updated 26.6.2020

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 1st quarter 2020. Helsinki: Statistics Finland [referred: 15.2.2026].

Access method: http://stat.fi/til/rtp/2020/01/rtp_2020_01_2020-06-26_tie_001_en.html