1. Changes to the Balance of Payments Statistics Caused by the Introduction of the New International Statistical Standards

Finland will start publishing the balance of payments and international investment position statistics in accordance with the new Balance of Payments and International Investment Position Manual (BPM6) on 11 July 2014.

Statistics compilation in accordance with BPM6 aims at better describing the current economic environment. The main changes of BPM6 include recording in accordance with the ownership principle and more coherent treatment of global value chains. As a result of globalisation and reduction of financial market regulation, capital movements across borders have become more significant. Enterprises' internal holding and financing structures have also become more complex. These changes are reflected in all items of the financial account.

This review presents the main changes in the balance of payments by sub-item caused by the new Balance of Payments and International Investment Position Manual.

1.1. Current account

The changes to the surplus/deficit of the current account caused by the new statistical standards were not substantial. Changes in entries are more visible in the sub-items. The figure 1 shows the current account balance in accordance with the old and new statistical standard.

Figure 1 Finland’s current account

1.1 .1 Goods and Services

1.1.1 .1 Merchanting

According to BPM6, merchanting is recorded in goods trade, when, according to the old manual, it was classified into services. The merchanting margin is calculated as the difference between sales and purchases in merchanting. In Finland, merchanting is further categorised into actual merchanting and factoryless goods production 1) . The first item is recorded under merchanting and the latter under services in the sub-item coverage to processing.

-

Merchanting is defined as the purchase of goods by a resident (of the compiling economy) from a non-resident, combined with the subsequent resale of the same goods to another non-resident without the goods being present in the compiling economy.

-

Factoryless goods production refers to activities where the enterprise has no actual manufacturing in its home country, but undertakes all of the entrepreneurial steps and arranges the availability of the capital, labour, and material inputs required to make a good. The enterprise produces the actual goods abroad and receives considerable added value on the product for example from product planning and R & D work.

1.1.1.2 Manufacturing services

Manufacturing services are included in services, and not in goods trade as in the previous manual. In manufacturing services only the margin of the actual processing, i.e. the value of the manufacturing service is included in service exports. The entries are made based on financial ownership.

In future time series calculation will be based on data acquired from large enterprises, the National Board of Customs’ Foreign Trade Statistics, and Statistics Finland's statistics on international trade in services. The source for the monthly preliminary data of the balance of payments is based only on the data from the National Board of Customs’ Foreign Trade Statistics.

-

In manufacturing services, goods are sent to a resident in another economy for further processing or remodelling and they are returned to the resident economy without a change in the ownership of the goods during the process.

1.1.1.3 Service sub-items

The sub-items of services have changed slightly: manufacturing services, and maintenance and repair services now form their own sub-items. The item telecommunication, data processing and information services combines items that were previously separated. Postal and courier services are included in transport services.

1.1.1.4 Financial intermediation services indirectly measured (FISIM)

A new balance of payments requirement is to include financial intermediation services indirectly measured in services. The counter item of FISIM is recorded in the primary income account. FISIM refers to the net interest income that is generated when a financial intermediary charges indirectly for the services it offers. This means that the financial intermediary charges a higher interest from the receiver of the financing than it pays to the provider of the financing.

1.1.1.5 Vessel deliveries

Vessel deliveries are recorded in the balance of payments as general merchandise. Vessel deliveries include, for example, goods and fuels acquired from ports and terminals.

1.1.2 Primary income and secondary income

Primary income and secondary income replace the income and current transfers of the old manual. In both accounts, the classification has been specified: the primary income account has a new item "other primary income".

A new item in the primary income account is reinvested earnings of investment funds. Profits from growth shares of investment funds are not paid as dividends to the shareholders but are reinvested and this item is recorded in the current account in the reinvested earnings of investment funds. This item has already previously been recorded in national accounts, so the balance of payment statistics move closer to national accounts in this respect as well. In addition, the primary income account includes taxes and product fees that previously were recorded in the current transfers.

1.2 Financial account and international investment position

In financial account and international investment position, the new recording methods increase gross assets and liabilities. By contrast, the new recording methods had less impact on the international net investment position. The figure shows the international net investment position in accordance with the old and new statistical standards.

Figure 2 Finland’s international investment position

1.2.1 Direct investments

In the financial account, the largest adjustments can be seen in direct investments (definition of direct investments http://tilastokeskus.fi/til/mata/kas_en.html ).

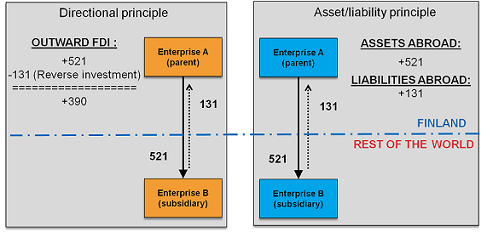

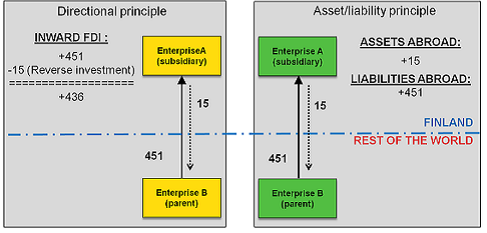

In BPM6, direct investments are reported as the gross amount according to the asset/liability principle. In addition, direct investments are published as their own statistical area, Foreign direct investments, where these investments are shown as netted (following the so-called revised directional principle). Due to presentation differences, the figures given in the statistics differ from one another but are, however, congruent.

The statistics reform raises the direct investment figures presented in the financial account of the balance of payments statistics. This is due to the fact that investments are presented in gross amounts according to the asset/liability principle instead of earlier netted figures in accordance with the directional principle. Figures according to the asset/liability principle do not include so-called reverse investments. Similarly, in figures accordant with the directional principle, reverse investments are taken into consideration and items between fellow enterprises are netted more extensively than before, which decreases the figures.

Starting from the statistical reference year 2013, the figures of direct investments are given as gross amounts in the balance of payments statistics and the figures are also available for the years prior to this. The statistics reform causes a break in the statistics on direct investments in accordance with the directional principle. Starting from the statistical reference year 2013, items between affiliates are, in accordance with the renewed directional principle, reported in the annual statistics on foreign direct investments, whose first release is on 31 October 2014. For the years prior to 2013, the Bank of Finland has estimated the capital stock and items between fellow enterprises in accordance with the renewed directional principle for the years 2009 to 2012 for the Coordinated Direct Investment Survey (CDIS) of the International Monetary Fund (IMF). For the year 2008, data on capital stock and items between fellow enterprises in accordance with the renewed directional principle have been presented in the Bank of Finland's BoF Online publication where the statistics reforms that apply to direct investments have also been discussed at a more detailed level ( http://www.suomenpankki.fi/fi/julkaisut/selvitykset_ja_raportit/bof_online/Documents/BoF_Online_04_2011.pdf ) The directional principle is recommended to be applied in connection with analysis of direct investments by country or sector.

The example below illustrates the difference between the directional principle and the asset/liability principle in the statistics on direct investments. Figure 3 shows Finland's outward FDI both based on the directional principle and the asset/liability principle using the flows of August 2013. In Finland's outward FDI, the group parent is located in Finland.

Figure 3 Finland’s outward FDI according to the directional principle and the asset/liability principle, flows of direct investments in August 2013

Figure 4 shows Finland's inward FDI based on the directional principle and the asset/liability principle. In Finland's inward FDI, the group parent is located abroad.

Figure 4 Finland’s inward FDI according to the directional principle and the asset/liability principle, flows of direct investments in August 2013

Table 1 shows a summary of the figures for August 2013. According to the directional principle, more direct investments flowed from abroad to Finland than from Finland abroad. According to the asset/liability principle, Finland's net foreign debt increased. If netted, the figures according to the directional principle and the asset/liability principle are congruent but present the same issue from different perspectives.

Table 1 Summary of flows in August 2013 in accordance with the directional principle and the asset/liability principle

| Directional principle | Asset/liability principle | ||

| OUTWARD | 390 | ASSETS | 536(=521+15) |

| INWARD | 436 | LIABILITIES | 582(=131+451) |

| Net | -46 | Net | -46 |

1.2.2 Portfolio investments

The globalisation of investment operations has increased international investments of Finnish investors, as well as investments to Finland. In addition, the development of financial instruments presents extra challenges for statistics production. In the reform, no new recording practices were introduced for portfolio investments, however. The recording of portfolio investments in the balance of payments statistics was renewed at the beginning of 2009 and this reform enabled several breakdowns of portfolio investments.

1.2.3 Financial derivates

The recording of flows in financial derivatives has shifted from net recording to gross amount recording as a result of the statistics reform, which means that assets and debts are separated in the derivative flows. In practice, all payments received from abroad related to derivatives are recorded to decrease financial assets, and payments made to foreign parties related to derivative contracts reduce financial debts. Payments made and received from the same party are not netted against each other. The gross amount recording increased the total flows related to financial assets and debts. The net amount item in the financial account is not affected by the change in the recording method

1.2.4 Other investments

Equity primarily consists of capital invested in the enterprise by its owners. As a result of the statistics reform, equity is divided into listed and unlisted and other equity. Other equity consists of equity that is not in the form of securities and that comprises holdings in branches and in other units without a separate legal identity. Holdings in international organisations are also included in other equity. Other equity is a new item that is added to the other investments in the financial account where no items belonging to equity have previously been recorded.

Further, due to the statistics reform the allocation of the International Monetary Fund's (IMF) Special Drawing Rights (SDRs) is presented as a separate item on the liability side of the financial account's other investments.

1) The factoryless goods production concept follows the definition of UN’s guide on The Impact of Globalization on National accounts (2011).

Source: Balance of payments and international investment position, Statistics Finland

Inquiries: Mira Malhotra 029 551 3411, Pauliina Turunen 029 551 2958, balanceofpayments@stat.fi.

Director in charge: Leena Storgårds

Updated 11.7.2014

Official Statistics of Finland (OSF):

Balance of payments and international investment position [e-publication].

ISSN=2342-348X. May 2014,

1. Changes to the Balance of Payments Statistics Caused by the Introduction of the New International Statistical Standards

. Helsinki: Statistics Finland [referred: 24.2.2026].

Access method: http://stat.fi/til/mata/2014/05/mata_2014_05_2014-07-11_kat_001_en.html