Published: 15 March 2016

Exports decreased in the fourth quarter, net international investment position contracted

The current account showed a slight surplus in the last quarter of 2015. The combined exports of goods and services decreased. The decline in exports steepened in January 2016. According to Statistics Finland's preliminary data, the current account showed a slight surplus in the whole year of 2015. Direct investment liabilities increased and the net international investment position contracted in the fourth quarter.

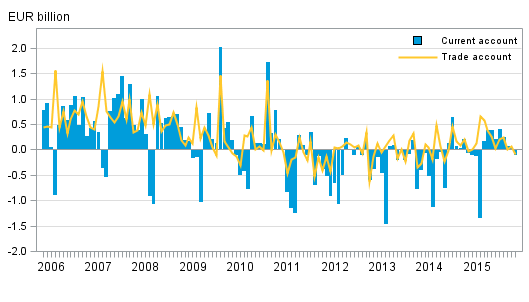

Finland’s current account and trade account

Current account in the fourth quarter

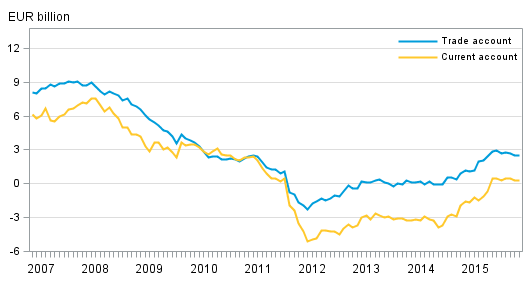

The current account showed a slight surplus, EUR 0.3 billion, in the last quarter of 2015. The current account for the whole year 2015 was also slightly in surplus, EUR 0.3 billion. From 2011 to 2014, the current account was clearly in deficit.

Exports of goods in balance of payment terms declined by four per cent in the fourth quarter from the corresponding period in the year before, and imports contracted by three per cent. The EUR 0.3 billion surplus in the goods account was lower than in the fourth quarter of 2014 as exports decreased faster than imports.

The EUR 2.5 billion surplus in the goods account for the whole year 2015 was highest in five years as imports of goods declined faster than exports of goods. The drop in the value of exports is explained by the decline in the value of oil products and heavily contracted Russian trade.

The service account showed a deficit of EUR 0.4 billion in the last quarter. The deficit of the service account for the whole year was EUR 1.3 billion. Exports of services increased by four per cent from the fourth quarter of 2014. In the biggest item in exports of services, “telecommunications, computer, and information services”, exports declined by one per cent in the fourth quarter. In the whole year 2015, the exports of this item increased by 8.6 per cent.

The deficit of the service account is mainly due to EUR 0.4 billion deficit in the travel balance. In the full year, the tourism balance deficit was a record high EUR 1.6 billion because tourism income from Russia has declined heavily and Finnish tourism expenditure abroad has continued growing at an annual level. The calculation method of tourism income was revised starting from the statistical reference year 2015.

The primary income account was EUR 0.9 billion in surplus in the fourth quarter, which is due to the surplus of investment income. The primary income account comprises, among other items investment income, which includes, for example, interest payments and receipts, and dividends. The secondary income account was EUR 0.5 billion in deficit.

Current account in January 2016

Exports of goods in balance of payment terms decreased heavily, by nine per cent from one year back. Goods imports declined by eight per cent. The goods account in balance of payment terms was EUR 0.1 billion in deficit. In January, the current account was almost in balance, EUR 0.1 billion in deficit. Of the sub-items, the primary income account was EUR 0.3 billion in surplus. The 12-month moving total of the current account was EUR 0.3 billion in surplus.

Finland’s current account and trade account, 12 –month moving sum

Financial account and international net investment position

Capital inflow to Finland in the last quarter of 2015

In the last quarter of 2015, net capital inflow to Finland amounted to EUR 4.9 billion. Inflow capital was mostly in the form of portfolio investments, EUR 4.9 billion net, and outflow capital was mostly in the form of other investments, EUR 3.5 billion. Other investments include, for example, loans, deposits and trade credits.

Table 1. External assets and liabilities by investment type in 2015 Q4, EUR billion

| Opening positiion 30.09.2015 | Financial transactions 2015 Q4 | Price changes 2015 Q4 | Changes in the exchange rates and valuation adjustments 2015 Q4 | Closing position 31.12.2015 | |

| Financial account | -0,4 | -4,9 | -4,4 | 1,7 | -8,0 |

| Assets | 734,4 | -59,4 | 18,4 | 4,4 | 697,8 |

| Liabilities | 734,8 | -54,5 | 22,8 | 2,7 | 705,8 |

| Direct investment | 8,6 | -3,8 | -0,5 | 0,5 | 4,8 |

| Assets | 131,0 | -1,9 | -0,2 | 0,7 | 129,6 |

| Liabilities | 122,5 | 1,9 | 0,3 | 0,2 | 124,9 |

| Portfolio investment | 0,3 | -4,9 | -3,1 | 1,2 | -6,4 |

| Assets | 285,2 | -0,4 | 4,1 | 2,3 | 291,3 |

| Liabilities | 284,9 | 4,5 | 7,2 | 1,1 | 297,7 |

| Other investment | -22,1 | 3,5 | 0,0 | -0,2 | -18,8 |

| Assets | 199,5 | -33,3 | 0,0 | 1,2 | 167,4 |

| Liabilities | 221,5 | -36,8 | 0,0 | 1,4 | 186,2 |

| Financial derivatives | 3,5 | 0,5 | -0,7 | 0,0 | 3,2 |

| Reserve assets | 9,3 | -0,2 | -0,1 | 0,2 | 9,2 |

Direct investment liabilities increased

During the fourth quarter, direct international investment liabilities grew by EUR 2.4 billion and assets declined by EUR 1.4 billion. At the end of 2015, international direct investment assets on gross stood at EUR 129.6 billion and the corresponding liabilities at EUR 124.9 billion.

Finland still has slightly more direct investment assets than liabilities as, at the end of 2015, assets exceeded liabilities by EUR 4.8 billion. The net investment position related to these investments has contracted heavily in the past two years as, at the end of 2013, direct investment assets exceeded liabilities by EUR 41.0 billion. The change in 2015 is mainly explained by changes in intra-group loans and trade credits. During 2015, these debt assets decreased by EUR 0.2 billion and the corresponding liabilities increased by EUR 13.7 billion.

Price changes increased portfolio investments

At the end of 2015, external portfolio investment assets stood at EUR 291.3 billion, of which EUR 149.3 billion were investments in shares and mutual fund shares, and EUR 142.0 billion in bonds and money market instruments. In the fourth quarter of 2015 foreign investments in equity and mutual fund shares increased by EUR 3.4 billion and debt securities decreased by EUR 3.9 billion.

At the end of 2015, external portfolio investment liabilities stood at EUR 297.7 billion, of which EUR 102.2 billion were investments in shares and mutual fund shares, and EUR 195.4 billion in bonds and money market instruments. In the fourth quarter, foreign investors increased their investments in Finnish shares and mutual fund shares by EUR 3.0 billion and in debt securities by EUR 1.4 billion. Portfolio investment liabilities grew by EUR 12.8 billion in the last quarter of 2015. Changes in security prices increased liabilities by EUR 7.2 billion and other valuation changes by EUR 1.1 billion.

Other investment liabilities decreased more than assets

In the fourth quarter of 2015, net capital outflow from Finland of other investments, i.e. loans, deposits and trade credits amounted to EUR 3.5 billion. The net investment position related to other investments improved by EUR 3.3 billion in the fourth quarter of 2015 when the share of other adjustments, EUR -0.2 billion, is included. At the end of the year, assets from other investments amounted to EUR 167.4 billion and liabilities to EUR 186.2 billion. Of these assets, EUR 139.5 billion and of the liabilities, EUR 155.7 billion were held by financial institutions.

Financial derivatives -related investments decreased

At the end of December, Finland had EUR 3.2 billion net assets in financial derivatives, which is EUR 0.2 billion less than at the end of September. Derivative-related assets and liabilities decreased clearly in the fourth quarter.

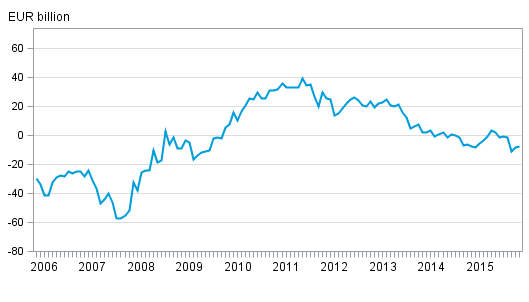

The net international investment position contracted further

At the end of December 2015, Finland had EUR 697.8 billion in foreign assets and EUR 705.8 billion in foreign liabilities. The net international investment position was negative at the end of the quarter as there were EUR 8.0 billion more liabilities than assets. Both international assets and liabilities have decreased over the past three quarters and are now at the lowest since the second quarter of 2014.

At the end of September 2015, the net investment position was EUR 0.4 billion negative so the net decrease was EUR 7.6 billion. During the last quarter, assets contracted by EUR 36.6 billion and liabilities by EUR 29.0 billion. Price changes related to foreign assets and liabilities decreased the net investment position by EUR 4.4 billion in the fourth quarter. Changes in exchange rates and other valuation changes improved the net investment position by EUR 1.7 billion.

Financial account and international investment position in January 2016

In January, the net inward capital flow to Finland was EUR 1.0 billion. Inward capital flow was highest in the form of portfolio investments, altogether EUR 13.0 billion. Outward capital flow was highest in direct investments, EUR 9.9 billion.

Finland's net investment position was negative at the end of January, as foreign assets amounted to EUR 744.5 billion and foreign liabilities to EUR 752.0 billion.

The data for February 2016 will be published on 15 April 2016.

Finland’s international investment position monthly

Source: Balance of payments and international investment position, Statistics Finland

Inquiries: Tapio Kuusisto 029 551 3318, Mira Malhotra 029 551 3411, balanceofpayments@stat.fi.

Director in charge: Ville Vertanen

Publication in pdf-format (304.0 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Finland's current account, quarterly 2015, EUR million (15.3.2016)

- Appendix table 2. External assets and liabilities by sector, quarterly 2015, EUR million (15.3.2016)

- Appendix table 3. International investment position by sector, quarterly 2015, EUR million (15.3.2016)

- Appendix table 4. Finland's balance of payments 2016, EUR million (15.3.2016)

Updated 15.03.2016

Official Statistics of Finland (OSF):

Balance of payments and international investment position [e-publication].

ISSN=2342-348X. January 2016. Helsinki: Statistics Finland [referred: 17.2.2026].

Access method: http://stat.fi/til/mata/2016/01/mata_2016_01_2016-03-15_tie_001_en.html