Published: 23 June 2021

Financial position of general government improved slightly from the previous quarter

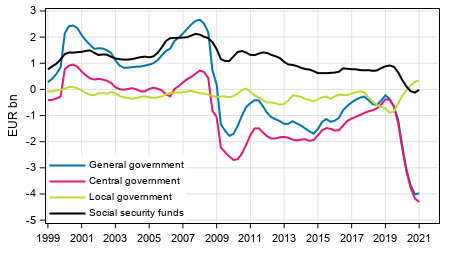

In the first quarter of 2021, consolidated total general government revenue grew by EUR 0.8 billion from the corresponding quarter of the previous year. Consolidated total expenditure increased by EUR 1.6 billion from the previous year’s corresponding quarter. The difference between revenue and expenditure, that is, the net borrowing of general government grew by EUR 0.8 billion from the respective quarter of the year before. Compared to the fourth quarter of 2020, seasonally adjusted income grew and seasonally adjusted expenditure decreased. Thus, the financial position of general government did not worsen further in the first quarter of 2021 from the previous quarter. In the first quarter of 2021, the general government deficit (net borrowing) stood at EUR 1.7 billion. These data derive from Statistics Finland’s statistics on general government revenue and expenditure by quarter. General government is comprised of central government, local government and social security funds.

General government’s net lending (+) / net borrowing (-), trend

Changes from the respective quarter of the year before

Examinations of year-on-year changes are made with figures unadjusted for seasonal variation. As a result of the corona crisis, central government expenditure grew and revenue diminished from the respective quarter of the year before. In the first quarter, central government's total revenue amounted to EUR 14.1 billion and total expenditure was EUR 17.7 billion. Central government's total revenue went down by 0.9 per cent from the respective quarter of the year before. The revenue item that decreased most was property income. However, tax revenues grew slightly. The most significant of the taxes remaining lower than in the previous year were profits from gambling activities included in taxes on production and imports, motor vehicle and motorcycle tax, and lottery tax, the tax rate of which declined considerably at the turn of the year. Total expenditure increased by 7.0 per cent from the respective quarter of the year before. The expenditure items that grew most were current transfers paid to general government and subsidies paid. The difference between revenue and expenditure, that is, the central government deficit was EUR 3.6 billion in the first quarter.

Local government's total revenue was EUR 14.4 billion in the first quarter. Compared to the corresponding quarter of the previous year it grew 6.0 per cent. Of revenue, most increase was recorded in income taxes. The change in the distribution share of corporation tax between central and local government is visible in national accounts only starting from the second quarter of 2020. In addition, persons' income tax grew. In the first quarter, local government's total expenditure was EUR 13.3 billion. It went up by 3.8 per cent. In expenditure, most growth was seen in intermediate consumption. The difference between revenue and expenditure, that is, the surplus (net lending) of local government was EUR 1.1 billion, while in the corresponding quarter of 2019, local government showed a surplus of EUR 0.7 billion.

Social security funds include employment pension schemes and other social security funds. In the first quarter, employment pension schemes' total revenue amounted to EUR 7.8 billion and total expenditure to EUR 7.3 billion. Total revenue increased by EUR 0.2 billion or by 3.1 per cent from the corresponding quarter in the year before and total expenditure increased by EUR 0.2 billion or by 2.9 per cent. The revenue items that grew most were property income, and in expenditure, paid pensions. The difference between revenue and expenditure, that is, the surplus (net lending) of employment pension schemes was EUR 0.5 billion and grew by around EUR 0.03 billion from the year before.

Other social security funds' total revenue was EUR 5.4 billion in the first quarter. Total revenue increased by 10.1 per cent from the corresponding quarter of one year ago. Current transfers received by the sector from central government had most effect on the change in revenue, which grew by EUR 387 million or up by 11.8 per cent from the year before. The expenditure of other social security funds amounted to EUR 5.2 billion and increased by 7.4 per cent from the quarter last year. Expenditure was boosted most by paid social benefits other than social transfers in kind, which grew by EUR 289 million or 7.8 per cent from the previous year. The difference between revenue and expenditure, that is, the surplus (net lending) of other social security funds was EUR 260 million in the first quarter.

Changes from the previous quarter

Examinations of changes compared with the previous quarter are made with seasonally adjusted figures. Central government's total revenue did not grow in the first quarter of 2021. Central government's total expenditure decreased by 5.3 per cent from the previous quarter.

Local government's total revenue went down by 6.1 per cent from the previous quarter. Total expenditure increased by 0.8 per cent.

Employment pension schemes' total revenue went up by 2.3 per cent and total expenditure decreased by 0.6 per cent from the previous quarter. Other social security funds’ total revenue increased by 2.4 per cent and total expenditure grew by 1.5 per cent from the previous quarter.

The data for the two latest years are preliminary and will become revised as annual national accounts data are revised. Seasonally adjusted and trend time series have been calculated with the Tramo/Seats method. Seasonally adjusted and trend time series always become revised against new observations irrespective of whether the original time series becomes revised or not. The data in the publication are based on the data sources available by 17 June 2021. As the time series of the annual national accounts become revised on 14 July 2021, the database tables of these statistics will also be updated. Data for the second quarter of 2021 will be published 17 September 2021. The responsibility for collecting quarterly data on the finances of municipalities and joint municipal authorities was transferred from Statistics Finland to the State Treasury in early 2021: http://www.stat.fi/uutinen/quarterly-local-government-finances-published-for-the-first-time-on-the-exploreadministrationfi-service The aim of the new data collection has been advanced automation. In addition, the collected data content is wider than before. Changes may initially have an effect on the quality and comparability of data concerning general government.

Source: General government revenue and expenditure,1th quarter 2021. Statistics Finland

Inquiries: Jouni Pulkka 029 551 3532, Jens Melfsen 029 551 2578, rahoitus.tilinpito@stat.fi

Head of Department in charge: Katri Kaaja

Publication in pdf-format (422.2 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

-

- Appendix figure 1. Social benefits other than social transfers in kind (23.6.2021)

- Appendix figure 2. Actual social contributions (23.6.2021)

- Appendix figure 3.Current Taxes on Income, Wealth, etc., trend (23.6.2021)

- Appendix figure 4. Taxes on Production and Imports (23.6.2021)

- Appendix figure 5. Total revenue, trend (23.6.2021)

- Appendix figure 6. Total expenditure, trend (23.6.2021)

- Appendix figure 7. Final Consumption expenditure, trend (23.6.2021)

- Appendix figure 8. Gross savings, trend (23.6.2021)

- Revisions in these statistics

-

- Revisions in these statistics (23.6.2021)

Updated 23.06.2021

Official Statistics of Finland (OSF):

General government revenue and expenditure by quarter [e-publication].

ISSN=1797-9382. 1st quarter 2021. Helsinki: Statistics Finland [referred: 9.3.2026].

Access method: http://stat.fi/til/jtume/2021/01/jtume_2021_01_2021-06-23_tie_001_en.html