Published: 13 December 2019

Current account in surplus in the third quarter, net international investment position strengthened

The current account was in surplus in the third quarter of 2019. The value of goods exports in balance of payments terms remained on level with the corresponding quarter of last year. Service exports grew strongly, which resulted in the service account turning to surplus. The primary income account was also in surplus. The net international investment position strengthened. The data appear from Statistics Finland's statistics on balance of payments and international investment position.

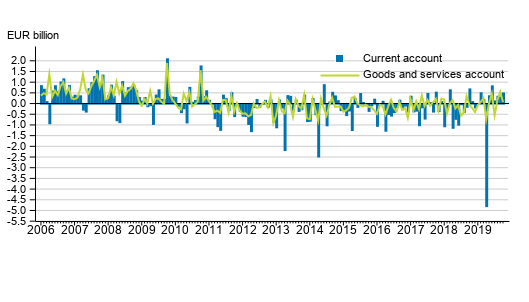

Current account and goods and services account

Current account

In the third quarter of 2019, the current account was EUR 0.8 billion in surplus. The balance of goods and services showed a surplus of EUR 0.2 billion. Of the sub-items of the current account, the primary income account was EUR 1.2 billion in surplus and the secondary income account EUR 0.6 billion in deficit.

Goods and services

The trade account in balance of payments terms was EUR 0.1 billion in deficit in the third quarter of 2019. In the corresponding quarter of the previous year, the trade account deficit amounted to EUR 0.2 billion. The service account showed a surplus of EUR 0.2 billion in the third quarter of 2019. The surplus in the service account is primarily explained by strong growth in the export of IT services.

Goods exports in balance of payments terms amounted to EUR 15.4 billion in the third quarter of 2019, which means that goods exports remained on level with the corresponding quarter of last year. Goods imports amounted to EUR 15.5 billion, so goods imports declined by 1 per cent from the third quarter in 2018. In the third quarter of 2019, service exports grew by 17 per cent and service imports by 7 per cent compared to the corresponding quarter of the previous year. Service exports amounted to EUR 7.9 billion and service imports to EUR 7.6 billion.

More detailed import and export figures in balance of payments terms by service item and area can be found in the statistics on international trade in goods and services starting from 2015. Decreases and increases made to the Finnish Customs figures, which result in goods trade in balance of payments terms, are also broken down in the statistics on international trade in goods and services.

Primary income in the third quarter

The primary income account was EUR 1.2 billion in surplus in the third quarter of 2019. The primary income account includes compensation of employees, investment income and other primary income paid abroad from Finland and from abroad to Finland. The surplus of primary income was mainly due to investment income, which includes such as returns on capital like interests and dividends. A total of EUR 1.1 billion were paid to Finland in investment income on net in the third quarter of 2019.

The secondary income account was EUR 0.6 billion in deficit in the third quarter of 2019.

Current account in surplus in October 2019

The current account showed a surplus in October. The value of exports of goods in balance of payments terms decreased by three per cent from one year ago. Of the sub-items of the current account, the primary income account and trade account were in surplus. The service account in balance of payments terms and the secondary income account were in deficit.

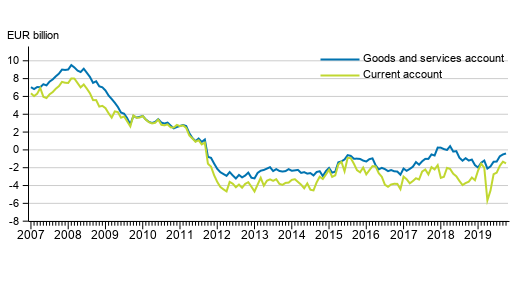

Finland’s current account and goods and services account, 12 –month moving sum

Financial account and net international investment position

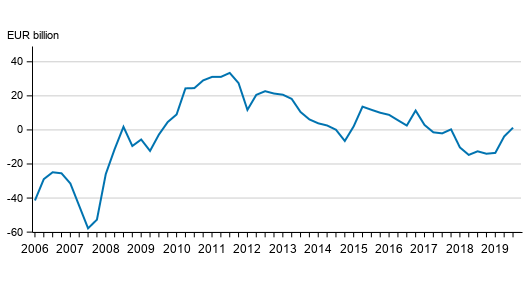

Net international investment position strengthened from the previous quarter

At the end of the third quarter of 2019, Finland foreign assets amounted to EUR 856.2 billion on gross and EUR 854.9 billion in foreign liabilities on gross. The net international investment position, that is, the difference between the stock of assets and liabilities, was thus EUR 1.3 billion as there were more assets than liabilities. Both gross assets and gross liabilities grew substantially, which was mainly due to growth in financial derivatives' stocks.

The net international investment position improved from the previous quarter when the net international investment position was EUR -3.8 billion. Financial transactions stood for EUR 0.9 billion and changes in classifications and other valuation changes for EUR 4.3 billion of the change in the net international investment position.

Examined by type of investment, the biggest gross assets, EUR 334.0 billion were in portfolio investments. Gross assets of bonds and money market instruments amounted to EUR 135.9 billion and equity and investments fund shares EUR 204.1 billion. Gross assets in direct investments amounted to EUR 165.4 billion and other investments EUR 267.6 billion.

Portfolio investments had also the biggest gross liabilities with EUR 441.8 billion. Gross liabilities of direct investments amounted to EUR 115.3 billion and other investments EUR 252.6 billion respectively.

Examined by type of investment, the biggest net assets, EUR 50.1 billion were in direct investments. Highest net liabilities, EUR 71.8 billion were in portfolio investments, which is explained by the stock of liabilities in bonds and money market instruments which had a net liability of EUR 133.6 billion. However, equity and investments fund shares amounted to a net surplus of EUR 61.8 billion.

Finland’s net international investment position quarterly

Capital outflow from Finland in the form of portfolio investments

In the third quarter of 2019, net capital outflow from Finland was largely in form of portfolio investments, which amounted to an outflow of EUR 3.3 billion. Capital inflow to Finland was in the form of other investments, which amounted to an inflow of EUR 3.7 billion.

Examined by investor sectors, foreign assets increased most in the other monetary financial institutions and social security funds. Growth in the stock of liabilities is due to the growth in the liabilities of the government sector. When the net investment position is examined by sector, social security funds had most net foreign assets, EUR 153.5 billion, of which employment pension schemes comprise the majority. EUR 113.2 billion of social security funds’ net foreign assets were in shares and mutual fund shares. Other monetary financial institutions, EUR 146.5 billion and enterprises, EUR 88.7 billion had most net liabilities.

Financial account in October 2019

Financial account showed net capital outflow of EUR 2.6 billion. By functional category, net capital outflow was in form of other investments 1.7 billion and in form of portfolio investments 1.5 billion.

Source: Balance of payments and international investment position, Statistics Finland

Inquiries: Hanna Björklund 029 551 3296, Mira Malhotra 029 551 3262, balanceofpayments@stat.fi.

Director in charge: Ville Vertanen

Publication in pdf-format (329.2 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

Updated 13.12.2019

Official Statistics of Finland (OSF):

Balance of payments and international investment position [e-publication].

ISSN=2342-348X. October 2019. Helsinki: Statistics Finland [referred: 2.3.2026].

Access method: http://stat.fi/til/mata/2019/10/mata_2019_10_2019-12-13_tie_001_en.html