Published: 11 July 2013

Households' indebtedness calmed down in the first quarter of 2013

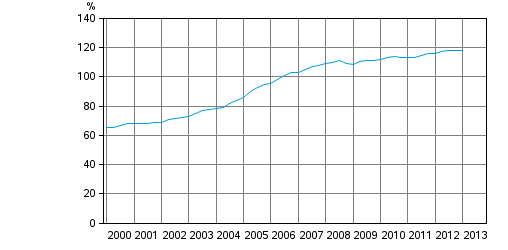

Households' indebtedness stood at 118.4 per cent at the end of the first quarter of 2013. Indebtedness has, in practice, remained unchanged for the past three quarters. Indebtedness has increased by 2.5 percentage points from one year ago. These data derive from Statistics Finland’s financial accounts statistics.

Households' indebtedness ratio

Households' net financial assets stood at EUR 90.7 billion at the end of the first quarter of 2013. Households' net financial assets increased by EUR 3.1 billion during the quarter as financial assets grew more than debts. Households' financial assets increased primarily due to holding gains accrued from shares and equity. At the end of the first quarter of 2013, households had a total of nearly EUR 224.1 billion in financial assets and EUR 133.5 billion in debt.

During the first quarter of 2013, households' loan stock grew by nearly EUR one billion, which was roughly the same as in the previous quarter. However, debts grew slightly more strongly than disposable income, as a result of which household's indebtedness went up to 118.4 per cent. Households' indebtedness is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

Households' net investments in quoted shares picked-up clearly at the beginning of the year. Otherwise, there were no clear changes in households’ investment behaviour. As in the two previous quarters, households transferred their saving assets from fixed-term deposits to cash deposits.

Non-financial corporations debt financing went up by two per cent to EUR 213.9. The loan stock grew by EUR 2.3 billion. The stock of debt securities issued by non-financial corporations, in turn, rose by EUR 1.6 billion. Debt financing refers to the total of loan debts and financing in the form of debt securities.

Source: Financial accounts, Statistics Finland

Inquiries: Martti Pykäri 09 1734 3382, rahoitus.tilinpito@stat.fi

Director in charge: Leena Storgårds

Publication in pdf-format (260.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 11.7.2013

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 1st quarter 2013. Helsinki: Statistics Finland [referred: 3.3.2026].

Access method: http://stat.fi/til/rtp/2013/01/rtp_2013_01_2013-07-11_tie_001_en.html