Published: 20 December 2019

Households’ net financial assets decreased in the third quarter of 2019

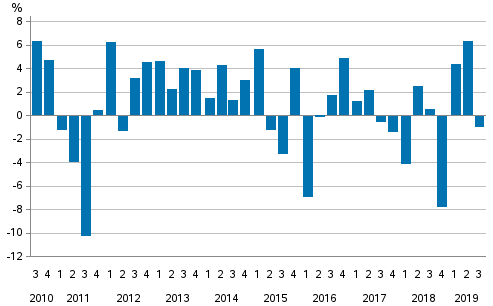

Households’ financial assets grew by EUR 4.2 billion during the third quarter of 2019 amounting to EUR 323.3 billion. Total households’ debts increased by EUR 5.5 billion during the third quarter of 2019 rising to EUR 180.9 billion. As a result of these changes, households' net financial assets decreased by EUR 1.3 billion to EUR 142.5 billion. Net financial assets refer to the difference between financial assets and liabilities. These data derive from Statistics Finland’s financial accounts statistics.

Change from the previous quarter in households’ net financial assets

Increase in debosits boosted households’ financial assets

During the third quarter of 2019, households increased their net investments in financial assets by EUR 2.2 billion. Households’ investments on net increased in deposits, quoted shares and mutual funds but decreased in debt securities. Holding gains also had a considerable effect on the increase in financial assets..

Households’ indebtedness ratio decreased

Households’ loan debts grew by EUR 1.9 billion during the third quarter of 2019 rising to EUR 155.4 billion. Households' indebtedness ratio went down by 1.3 percentage points from the previous quarter to 127.2 per cent. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

The biggest reason for the decrease in households’ indebtedness was that households’ disposable income grew in the third quarter of 2019. The considerable increase in disposable income is mainly the result of a change in the tax rebate policy: previously all tax rebates were paid in December but starting from 2019, the tax rebates are paid gradually to households starting from July. Tax rebates are taken into account as deductions in paid taxes. Thus, the taxes paid by households decreased by good EUR 1.6 billion from the corresponding quarter in 2018. The change in the tax rebate policy will also be visible in the last quarter of 2019 when the taxes paid by households will increase considerably compared to the corresponding quarter last year and will decrease households’ disposable income correspondingly.

Non-financial corporations’ debt financing grew

Non-financial corporations’ debt financing increased by EUR 1.1 billion during the third quarter of 2019 rising to EUR 247.8 billion. In the third quarter of 2019, non-financial corporations’ financing in the form of debt securities increased by EUR 1.5 billion to EUR 33.1 billion, while non-financial corporations' loan debts went down by EUR 0.4 billion to EUR 214.7 billion. Debt financing refers to the total of loan debts and financing in the form of debt securities.

Source: Financial accounts, Statistics Finland

Inquiries: Tuomas Koivisto 029 551 3329, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (246.4 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

- Revisions in these statistics

-

- Revisions in these statistics (20.12.2019)

Updated 20.12.2019

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 3rd quarter 2019. Helsinki: Statistics Finland [referred: 23.2.2026].

Access method: http://stat.fi/til/rtp/2019/03/rtp_2019_03_2019-12-20_tie_001_en.html