This set of statistics has been discontinued.

New data are no longer produced from the statistics.

Published: 31 October 2018

Profits of insurance companies grew in 2017

Non-life insurance, life insurance and employment pension insurance companies’ combined profit for the financial period grew in 2017 to EUR 1.3 billion from the previous year's EUR 0.8 billion. Insurance companies’ investment assets amounted to EUR 124 billion on 31 December 2017. In addition, life insurance companies had investments covering unit-linked insurances to the tune of EUR 38 billion.

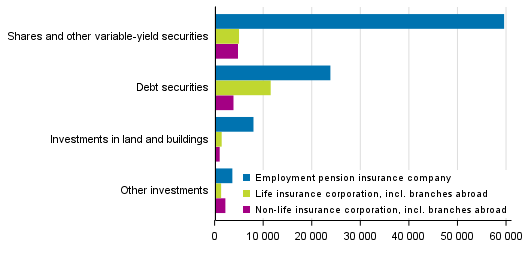

Insurance companies’ investment allocation on 31 December 2017, EUR million

Employment pension insurance companies

Employment pension insurance companies’ premium income and claims paid comprise of statutory pension insurance. Premium income and claims paid continued growing in 2017. Premium income grew by 3.6 per cent to EUR 14.1 billion. Claims paid, in turn, increased by 3.7 per cent to EUR 14.9 billion. Claims incurred, which in addition to claims paid, include change in the provision for outstanding claims, decreased from the previous year by EUR 3.2 billion to EUR 14.4 billion.

Investment activities were profitable for employment pension insurance companies in 2017. The net income of investments grew to EUR 8.7 billion from the previous year's EUR 4.5 billion. The income of investments grew by 6.9 per cent while their expenses declined by 7.8 per cent. In particular, lower sales losses decreased the expenses of investment activities. The balance sheet value of investments increased by 6.4 per cent to EUR 94.3 billion. Shares and participations continued growing at the same time as the share of money market instruments in investment assets continued their decline. The balance sheet value of shares and participations grew by 12.3 per cent to EUR 59.4 billion and their share was 63 per cent of all investments of employment pension insurance companies.

At the end of 2017, technical provisions totalled EUR 99.1 billion. The growth from the year before amounted to 8.2 per cent. The change in the technical provisions was due to the provision for unearned premiums growing by 17.3 per cent to EUR 54.2 billion.

Life insurance companies

Life insurance companies’ premium income and direct income claims paid remained in 2017 almost on level with 2016. Premium income totalled EUR 4.5 billion and claims paid EUR 4.2 billion. Premium income from life insurance amounted to EUR 3.9 billion and claims paid to EUR 2.9 billion. Premium income received from capital redemption policies turned upwards after the previous year, but premium income decreased in individual saving insurances and risk insurances. In claims paid, in turn, capital redemption policies went down slightly, while claims paid for individual saving insurances rose from one year back. Premium income received from pension insurance went down from EUR 672 million in 2016 to EUR 607 million. At the same time, claims paid from pension insurance, or pensions, fell by EUR one billion to EUR 1.3 billion.

The net income of investment activities dropped from the previous year by 3.5 per cent to EUR three billion. The income fell by 2.5 per cent to EUR 2.6 billion and the expenses rose by 11.6 per cent to EUR 1.3 billion. The net effect of investments’ unrealised value changes and value increases and their adjustments on the net income of investment activities remained clearly positive as in the previous year, being EUR 1.7 billion. The balance sheet value of investments continued declining. The investment assets of life insurance companies totalled EUR 18.6 billion at the end of 2017, which is 6.7 per cent less than in 2016. Money market investments were still the biggest investment item of the balance sheet, covering 61.1 per cent of all investments of life insurance companies. The role of unit-linked insurances in the business activity of life insurance companies has grown in recent years. In 2017, the balance sheet value of the investments covering unit-linked insurances was EUR 37.8 billion, that is, 9.6 per cent bigger than in 2016.

Life insurance companies’ technical provisions without unit-linked insurances diminished from the year before by 5.6 per cent to EUR 17.8 billion. Technical provisions in total increased by 4.3 per cent to EUR 55.6 billion. The technical provisions of individual saving insurances and capital redemption policies particularly grew from the previous year. Employment insurances’ technical provisions remained almost at the same level as in the previous year, at EUR 20.8 billion.

The year 2017 was profitable for life insurance companies. The profit for the financial period grew to EUR 598 million from the previous year's EUR 237 million. As the net income of premium income, claims paid and investments remained almost on level with 2016, the decrease in the provision for unearned premiums largely explains the increased profit for the financial period.

Non-life insurance companies

A company restructuring was made in the non-life insurance segment in the last quarter of 2017, which had an effect on the combined financial statement figures of non-life insurance companies. For this reason, balance sheet items had big changes from the previous year's figures.

Non-life insurance companies’ premium income fell by 4.6 per cent to EUR 4.3 billion from one year ago. Claims paid went down by 9.5 per cent to EUR 2.7 billion. In most insurance classes, premium income and claims paid fell, but both sickness and other accident insurances grew a little. Claims paid for assumed reinsurance were positive (see Appendix table 4). This can happen, for example, when the shares of insurance portfolio transfers are bigger than the claims paid.

Operating expenses fell from EUR 877 million in 2016 by 3.4 per cent to EUR 847 million. Assets covering technical provisions after the equalisation provision were EUR 130 million lower than in 2016, EUR 158 million.

The net income of investment activities grew by 61 per cent to EUR 707 million. The income grew by 37 per cent to EUR 1.1 billion, while the expenses rose by 8.1 per cent to EUR 392 billion. Sales profits increased significantly the income of investment activities. Sales profits grew in 2017 to EUR 450 million from the previous year's EUR 260 million.

Due to the increased income of investment activities, non-life insurance companies’ profit/loss for the financial period improved from EUR 586 million by 20.1 per cent to EUR 704 million.

The balance sheets of non-life insurance companies decreased by 17.8 per cent and were EUR 13.6 billion at the end of 2017. In turn, investment assets declined by 20.2 per cent to EUR 11.2 billion. The most significant change in investment assets was the decrease in the balance sheet value of money market instruments from EUR 7.8 billion to EUR 3.7 billion. Thus, shares and participations, whose balance sheet value rose from EUR 3.8 billion to EUR 4.6 billion, became the biggest balance sheet item of non-life insurance companies. Their share was 41.4 per cent of all investments. On the liability side of balance sheets, technical provisions amounted to EUR 9.6 billion, that is, 22.7 per cent lower than in 2016. Own equity remained on level with the year before, amounting to EUR 3.2 billion. The share of own equity in the balance sheets grew to 23.4 per cent from 18.9 per cent in 2016.

More detailed information on insurance activities can be found in the database and appendix tables of the statistics and from the web pages of other organisations that produce insurance data (see in the left-hand menu under "Links" of the statistics' home page). The statistics on insurance activities cover activity data of employment pension insurance, life insurance and non-life insurance companies, such as profit and loss account, balance sheet, investments and class of insurance specific data. The data are based on the Financial Supervision Authority's data collection on domestic activities of corporations engaged in the insurance markets. The financial statement structure differs in many respects between employment pension insurance, life insurance and non-life insurance companies. The data concerning life insurance and non-life insurance companies also include branches abroad. For more information about the statistics and financial statement concepts, see the statistics homepage under “Quality description”.

Source: Insurance Activities 2017, Statistics Finland

Inquiries: Jarkko Kaunisto 029 551 3551, Antti Suutari 029 551 3257, rahoitusmarkkinat@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (311.1 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Balance sheets of insurance companies 2017, EUR million (31.10.2018)

- Appendix table 2. Investment income of insurance companies 2017, EUR million (31.10.2018)

- Appendix tabel 3. Insurance class-specific data of life insurance companies 2017 (31.10.2018)

- Appendix tabel 4. Insurance class-specific data of non-life insurance companies 2017 (31.10.2018)

- Figures

-

- Appendix figure 1. Distribution of insurance companies insurance premiums, EUR million (31.10.2018)

- Appendix figure 2. Distribution of insurance companies claims paid, EUR million (31.10.2018)

- Appendix figure 3. Insurance companies net profits from investments, EUR million (31.10.2018)

- Appendix figure 4. Non-life insurance companies premium income - class-specific data, EUR million (31.10.2018)

- Appendix figure 5. Life insurance companies number of insured in 2017 - class-specific data, pcs (31.10.2018)

Updated 31.10.2018

Official Statistics of Finland (OSF):

Insurance Activities [e-publication].

ISSN=2341-7625. 2017. Helsinki: Statistics Finland [referred: 19.2.2026].

Access method: http://stat.fi/til/vato/2017/vato_2017_2018-10-31_tie_001_en.html