Published: 17 September 2021

Financial position of general government improved by EUR 3.4 from the quarter one year ago

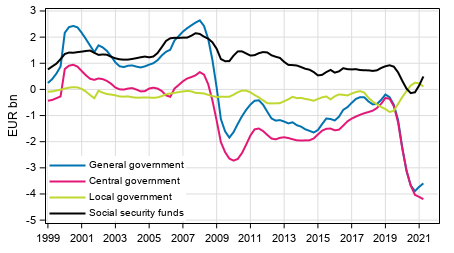

In the second quarter of 2021, consolidated total general government revenue grew by EUR 3.4 billion from the corresponding quarter of the previous year. Consolidated total expenditure did not grow much from the corresponding quarter of the previous year. The difference between revenue and expenditure, that is, the financial position of general government improved by EUR 3.4 billion from the respective quarter of the year before. Compared to the first quarter of 2021, seasonally adjusted revenue grew more than seasonally adjusted expenditure, that is, the financial position of general government improved in the second quarter of 2021 compared to the previous quarter. In the second quarter of 2021, the general government surplus (net lending) stood at EUR 0.5 billion. These data derive from Statistics Finland’s statistics on general government revenue and expenditure by quarter. General government is comprised of central government, local government and social security funds.

General government’s net lending (+) / net borrowing (-), trend

Changes from the respective quarter of the year before

Examinations of year-on-year changes are made with figures unadjusted for seasonal variation. In the second quarter, central government's total revenue amounted to EUR 16.1 billion and total expenditure to EUR 16.5 billion. Central government's total revenue grew by EUR 1.4 billion from the respective quarter of the year before. The revenue items that grew most were income taxes and taxes on products. In income taxes, the accrual of both income tax paid by corporations and personal income tax increased. In taxes on products, the biggest growth in accruals measured in euros compared to last year occurred in value added taxes, profits from gambling activities, and asset transfer taxes. The most significant of the taxes remaining lower than in the previous year were the alcohol tax and lottery tax, which are influenced by changes in the tax rate. Total expenditure decreased by EUR 1.1 billion from the corresponding quarter of the previous year. The expenditure items that decreased most were subsidies paid and current transfers paid. The difference between revenue and expenditure, that is, the central government deficit, was EUR 0.4 billion in the second quarter.

Local government's total revenue was EUR 14.0 billion in the second quarter. Compared to the corresponding quarter of the previous year it grew by 7.0 per cent. Of revenue, most increase was recorded in income taxes. The accrual of both income tax paid by corporations and personal income tax increased. In the second quarter of the year, local government's total expenditure was EUR 14.1 billion. It went up by 5.6 per cent. In expenditure, the growth was biggest in intermediate consumption. The difference between revenue and expenditure, that is, the deficit (net borrowing) of local government was EUR 0.1 billion, while it was EUR 0.2 billion in the corresponding quarter of the previous year.

Social security funds include employment pension schemes and other social security funds. In the second quarter, total revenue of employment pension schemes amounted to EUR 8.3 billion and total expenditure to EUR 7.4 billion. Total revenue increased by EUR 0.9 billion or by 12.9 per cent from the corresponding quarter in the year before and total expenditure increased by EUR 0.2 billion or by 2.5 per cent. The revenue items that grew most were social contributions received, and in expenditure, paid pensions. The difference between revenue and expenditure, that is, the surplus (net lending) of employment pension schemes was EUR 0.9 billion and grew by around EUR 0.8 billion from the corresponding quarter of the year before.

Other social security funds' total revenue was EUR 5.2 billion in the second quarter. Total revenue decreased by 3.0 per cent from the corresponding quarter of one year ago. Of the largest revenue items, social contributions received by the sector grew by EUR 211 million, but income transfers from central government decreased by EUR 378 million. The expenditure of other social security funds amounted to EUR 5.1 billion and it decreased by 2.7 per cent from the quarter last year. Paid social benefits other than social transfers in kind lowered the expenditure most, they went down by EUR 225 million or 5.4 per cent from the previous year. The difference between revenue and expenditure, that is, the surplus (net lending) of other social security funds was EUR 41 million in the second quarter.

Changes from the previous quarter

Examinations of changes compared with the previous quarter are made with seasonally adjusted figures. Central government's total revenue went up by 1.2 per cent from the previous quarter. Central government's total expenditure fell by 1.5 per cent from the previous quarter.

Local government's total revenue went down by 0.9 per cent from the previous quarter. Total expenditure increased by 1.7 per cent.

Employment pension schemes' total revenue went up by 4.1 per cent and total expenditure grew by 1.1 per cent from the previous quarter. Other social security fund’s total revenue remained on level with the previous quarter and total expenditure grew by 0.6 per cent.

The data for the two latest years are preliminary and will become revised as annual national accounts data are revised. Seasonally adjusted and trend time series have been calculated with the Tramo/Seats method. Seasonally adjusted and trend time series always become revised against new observations irrespective of whether the original time series becomes revised or not. The data in the publication are based on the data sources available by 10 September 2021. Data for the third quarter of 2021 will be published on 17 December 2021. The responsibility for collecting the quarterly financial data of municipalities and joint municipal authorities was transferred from Statistics Finland to the State Treasury at the start of 2021: http://www.stat.fi/uutinen/quarterly-local-government-finances-published-for-the-first-time-on-the-exploreadministrationfi-service The aim of the new data collection has been advanced automation. In addition, the collected data content is wider than before. Changes may initially have an effect on the quality and comparability of data concerning general government.

Source: General government revenue and expenditure,2nd quarter 2021. Statistics Finland

Inquiries: Jouni Pulkka 029 551 3532, Jens Melfsen 029 551 2578, rahoitus.tilinpito@stat.fi

Head of Department in charge: Katri Kaaja

Publication in pdf-format (423.2 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

-

- Appendix figure 1. Social benefits other than social transfers in kind (17.9.2021)

- Appendix figure 2. Actual social contributions (17.9.2021)

- Appendix figure 3.Current Taxes on Income, Wealth, etc., trend (17.9.2021)

- Appendix figure 4. Taxes on Production and Imports (17.9.2021)

- Appendix figure 5. Total revenue, trend (17.9.2021)

- Appendix figure 6. Total expenditure, trend (17.9.2021)

- Appendix figure 7. Final Consumption expenditure, trend (17.9.2021)

- Appendix figure 8. Gross savings, trend (17.9.2021)

- Revisions in these statistics

-

- Revisions in these statistics (17.9.2021)

Updated 17.09.2021

Official Statistics of Finland (OSF):

General government revenue and expenditure by quarter [e-publication].

ISSN=1797-9382. 2nd quarter 2021. Helsinki: Statistics Finland [referred: 9.3.2026].

Access method: http://stat.fi/til/jtume/2021/02/jtume_2021_02_2021-09-17_tie_001_en.html