Published: 18 June 2021

Current account in deficit in the first quarter, net international investment position strengthened

The current account was in deficit in the first quarter of 2021. The value of goods exports in balance of payments terms grew by 2 per cent from twelve months back. In turn, the value of goods imports decreased by 1 per cent. At the same time, the value of service exports decreased by 18 per cent year-on-year, as well as the value of service imports. The primary income account was in surplus. Compared to the previous quarter, the net international investment position strengthened. The data appear from Statistics Finland's statistics on balance of payments and international investment position.

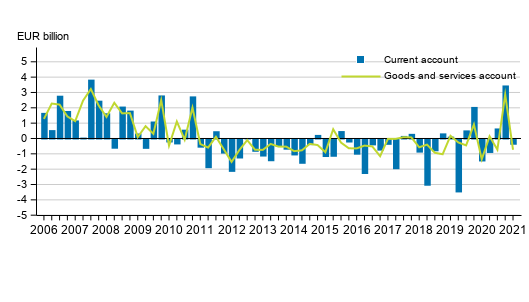

Current account and goods and services account

Current account

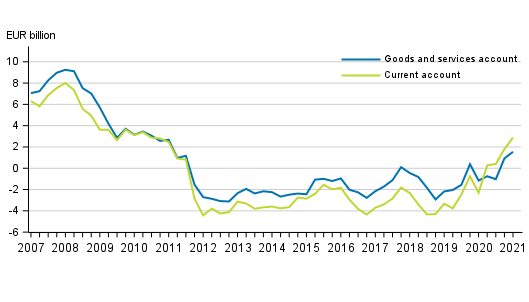

In the first quarter of 2021, the current account was EUR 0.3 billion in in deficit. The four-quarter moving total of the current account was EUR 2.9 billion in surplus. The balance of goods and services showed a deficit of EUR 0.7 billion. Of the sub-items of the current account, the primary income account was EUR 1.3 billion in surplus and the secondary income account was EUR 0.9 billion in deficit.

Goods and services

The goods account in balance of payments terms was EUR 0.3 billion in surplus in the first quarter. In the corresponding quarter of the previous year, the trade account was EUR 0.2 billion in deficit. The service account showed a deficit of EUR 1.0 billion in the first quarter of 2021.

The value of goods exports in balance of payment terms increased by two per cent year-on-year and was EUR 15.2 billion while the value of goods imports in balance of payment terms fell by one per cent year-on-year to EUR 14.9 billion. The value of service exports declined by 18 per cent year-on-year and totalled EUR 5.6 billion. The value of service imports, in turn, decreased by 18 per cent year-on-year to EUR 6.6 billion.

More detailed import and export figures in balance of payments terms by service item and area can be found in the statistics on international trade in goods and services starting from 2013. Decreases and increases made to the Finnish Customs figures, which result in goods trade in balance of payments terms, are also broken down in the statistics on international trade in goods and services.

Primary income

Primary income paid to Finland on net amounted to EUR 1.3 billion in the first quarter of 2021. Primary income paid from Finland to abroad amounted to EUR 3.9 billion, while primary income paid from abroad to Finland totalled EUR 5.2 billion.

In the first quarter of 2021, property income paid to Finland on net amounted to EUR 1.2 billion, while property income paid to Finland from abroad amounted to EUR 4.9 billion and property income paid abroad from Finland to EUR 3.7 billion. Most property income on net from abroad to Finland was paid in the form of direct investments, EUR 1.4 billion in the first quarter.

Finland’s current account and goods and services account, 12 –month moving sum

Financial account and net international investment position

Portfolio investments strengthened the net international investment position

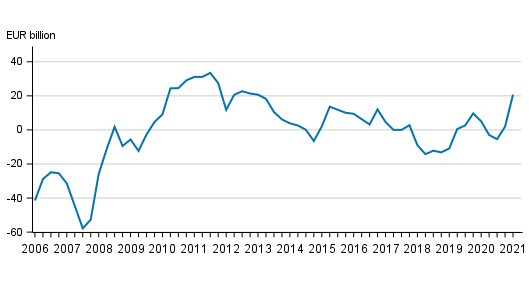

In the first quarter of 2021, Finland had EUR 897.6 billion in foreign assets on gross and EUR 876.9 billion in foreign liabilities on gross. The net international investment position, that is, the difference between the stock of assets and liabilities, was thus EUR 20.7 billion as there were more assets than liabilities. Gross assets increased mainly due to the grown stocks of other investments and portfolio investments. Gross liabilities also increased due to the increased stocks of other investments.

The net international investment position strengthened from the previous quarter when the net international investment position was EUR 1.9 billion. Financial transactions stood for EUR 2.7 billion of the rise in the net international investment position, while prices and exchange rates and other changes in classifications stood for EUR 23.0 billion.

Portfolio investment assets and liabilities grew

Examined by type of investment, there were most foreign assets in the form of portfolio investments at the end of the first quarter of 2021. Portfolio investment assets grew from the previous quarter. At the end of the first quarter of 2021, there were EUR 386.5 billion in portfolio investment assets, while in the previous quarter there were EUR 356.3 billion in assets. The change in stocks is almost entirely explained by changes in the prices of portfolio investments. Of portfolio investment assets, EUR 132.6 billion were in bonds and money market instruments and EUR 253.9 billion in equity and mutual fund shares.

The share of portfolio investments is also highest in foreign liabilities. Portfolio investment liabilities amounted to EUR 435.1 billion at the end of the first quarter of 2021. The stock of portfolio investment liabilities also grew from the previous quarter, when the stock of portfolio investment liabilities was EUR 433.9 billion. Portfolio investment liabilities were highest in the form of bonds and money market instruments, which stood at EUR 273.0 billion at the end of the fourth quarter.

Finland’s net international investment position quarterly

When examining the net international investment position by type of investment, it can be seen that the biggest net assets were in direct investments, while the largest net liabilities were in the form of portfolio investments. At the end of the first quarter of 2021, net assets in direct investments were EUR 53.6 billion and net liabilities in portfolio investments EUR 48.6 billion. The large net liability of portfolio investments is explained by the net liabilities of EUR 140.3 billion in bonds and money market instruments. Assets in equity and mutual fund shares were EUR 91.7 billion larger than liabilities.

Net capital inflow to Finland from abroad

In the first quarter of 2021, net capital inflow to Finland from abroad amounted to EUR 4.2 billion. Net capital inflow to Finland was mainly in the form of other investments, totalling EUR 8.1 billion. Net capital outflow from Finland abroad in the form of direct investments amounted to EUR 2.5 billion. Correspondingly, net capital inflow was mostly in the form of portfolio investments, EUR 5.3 billion.

Social security funds had largest net assets

When the net investment position is examined by investor sector, most foreign net assets, EUR 171.7 billion, were held by social security funds, of which employment pension schemes are the most important ones. EUR 142.1 billion of social security funds’ net assets were in the form of equity and mutual fund shares and EUR 25.9 billion in the form of money market instruments and bonds. The net assets of social security funds grew from the previous quarter primarily as a result of price changes in assets of equity and mutual fund shares. Net liabilities were held most by other monetary financial institutions, EUR 157.9 billion. The net investment position of monetary financial institutions weakened from the last quarter of 2020 due to the increase in the net liability of other investments.

Source: Balance of payments and international investment position, Statistics Finland

Inquiries: Hanna Björklund 029 551 3296, Johannes Nykänen 029 551 3641, balanceofpayments@stat.fi.

Head of Department in charge: Katri Kaaja

Publication in pdf-format (332.3 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Current account, quarterly 2021, EUR million (18.6.2021)

- Appendix table 2. External assets and liabilities by sector, quarterly 2021, EUR million (18.6.2021)

- Appendix table 3. International investment position by sector, quarterly 2021, EUR million (18.6.2021)

- Appendix table 4. Balance of payments, EUR million (18.6.2021)

Updated 18.6.2021

Official Statistics of Finland (OSF):

Balance of payments and international investment position [e-publication].

ISSN=2342-348X. 1st quarter 2021. Helsinki: Statistics Finland [referred: 12.3.2026].

Access method: http://stat.fi/til/mata/2021/41/mata_2021_41_2021-06-18_tie_001_en.html