Published: 12 April 2013

Holding gains increased households' financial assets in the last quarter of 2012

In the last quarter of 2012, households' financial assets grew more than debts, mainly because of holding gains accrued from quoted shares and mutual funds. Therefore, households' net financial assets, i.e. the difference between their financial assets and liabilities, continued to grow. As in the two previous quarters, households transferred their saving assets from fixed-term deposits to cash deposits. These data derive from Statistics Finland’s financial accounts statistics.

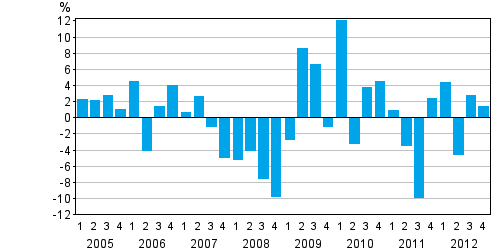

Change from the previous quarter in households' net financial assets

During the last quarter of 2012, households' loan debts grew by only EUR 0.8 billion, which is clearly less than in the earlier quarters of the year. However, debts grew more strongly than disposable income, because of which household's indebtedness ratio went up to 118.4 per cent.

Over 2012, households' loan debts grew by altogether EUR 6.1 billion, being EUR 123.4 billion at the end of December. During 2012, households' indebtedness ratio increased in all by 2.7 percentage points. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

In the last quarter of 2012, households' financial assets increased primarily due to holding gains accrued from quoted shares and mutual funds to the tune of EUR 1.2 billion. During the period, households' financial assets grew by altogether EUR 2.0 billion, being EUR 228.2 billion at the end of December. Households' net financial assets increased now for the second quarter in a row, as financial assets grew more than debts. At the end of 2012, households' net financial assets amounted to EUR 95.7 billion, which was EUR 3.5 billion more than one year previously.

As in the two previous quarters, households transferred their savings from fixed-term deposits to cash deposits. Cash deposits grew by EUR 1.4 billion to EUR 46.2 billion while fixed-term deposits went down by EUR 2.3 billion to EUR 34.0 billion.

The net financial position of non-financial corporations weakened slightly during the last quarter of the year. At the end of 2012, non-financial corporations had EUR 188.8 billion more debts than financial assets. During the last quarter, non-financial corporations decreased their debt financing by 1.6 per cent to EUR 211.9 billion. Debt financing refers to the total of loan debts and financing in the form of debt securities.

Source: Financial accounts, Statistics Finland

Inquiries: Martti Pykäri 09 1734 3382, rahoitus.tilinpito@stat.fi

Director in charge: Leena Storgårds

Publication in pdf-format (264.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 12.4.2013

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 4th quarter 2012. Helsinki: Statistics Finland [referred: 3.3.2026].

Access method: http://stat.fi/til/rtp/2012/04/rtp_2012_04_2013-04-12_tie_001_en.html