Published: 9 October 2013

Households’ indebtedness ratio remained unchanged in the second quarter of 2013

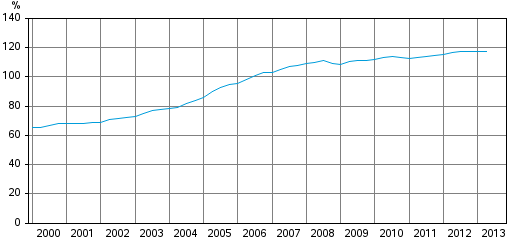

Households’ indebtedness ratio remained unchanged at 117.6 per cent in the second quarter of 2013. Indebtedness has increased by one percentage point from one year ago. These data derive from Statistics Finland’s financial accounts statistics.

Households' indebtedness ratio

During the second quarter of 2013, households' loan stock and disposable income grew in the same proportion, as a consequence of which households' indebtedness ratio remained unchanged at 117.6 per cent. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

At the end of the second quarter of 2013, households had a total of nearly EUR 229.3 billion in financial assets and EUR 134.6 billion in debt. During the quarter, financial assets grew more than their debts, as a result of which households' net financial assets, i.e. the difference between their financial assets and debts, grew by EUR 1.8 billion to EUR 94.6 billion.

Households’ investment behaviour was relatively moderate in the second quarter of 2013. As the low level of interest rates continued, households continued to transfer their assets from fixed-term deposits to cash deposits. Households' net investments in quoted shares were seen to pick up clearly in the previous quarter, but now investments turned again negative.

As in the previous quarter, non-financial corporations' debt financing, i.e. loan debts and financing in the form of debt securities, grew. Debt financing was increased by taking out loans. However, there was not much change in the total level of non-financial corporations' debts, because debts correspondingly decreased due to the weaker market value of quoted shares. When non-financial corporations' financial assets continued to fall, the net financial position of non-financial corporations went down to EUR -209 billion, which is EUR 28.9 billion less than one year ago. Financial assets contracted particularly due to diminishing deposit assets.

Source: Financial accounts, Statistics Finland

Inquiries: Martti Pykäri 09 1734 3382, rahoitus.tilinpito@stat.fi

Director in charge: Leena Storgårds

Publication in pdf-format (262.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 9.10.2013

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 2nd quarter 2013. Helsinki: Statistics Finland [referred: 9.3.2026].

Access method: http://stat.fi/til/rtp/2013/02/rtp_2013_02_2013-10-09_tie_001_en.html