1. Utilisation of new data sources lowered households’ indebtedness ratio slightly

Households’ imputed share of housing companies’ loan stock has been recorded as households’ loan debts in financial accounts. The model used thus far to determine the imputed share was based on the transfer made to households from housing companies’ loan stock derived from background information concerning primarily only state-subsidised loans and interest-subsidised loans. The model was static and based largely on the operating environment at that time and its assumptions have slowly moved further from the market development.

The model has not been able to sufficiently estimate the increased importance of property investment funds, enterprises that make property investments and other institutional investors as owners of dwellings. The model has also not been able to sufficiently consider the latest available source data and there has not been sufficient basic information on the share of new actors. Therefore, the total amount of households’ debts and their growth rate have appeared as too high in household data.

In connection with the September time series revision of the national accounts, a new method has been developed for the financial accounts that utilises new sources in the calculation of households’ share of housing company loans. The model equalises the imputed share of housing company loans belonging to households as households’ loan debt. The new model considers, in addition to financial institutions balance sheet data of the Bank of Finland, also the financial statement data included in Statistics Finland’s enterprise database, as well as the Tax Administration's asset transfer tax data and business taxation file data more extensively than before. It should be noted that all of these source data could not previously be used jointly to the required extent.

When using the new model, households’ share in housing company loans decreased by EUR one to six billion depending on the year. The difference between the methods has been at its highest between 2015 and 2017 when the growth rate of housing starts for dwellings in new blocks of flats made a sharp upturn. The difference has decreased slightly in the calculation of the different quarters of 2018 and has stabilised at around EUR five billion. The methodological revision affects households’ indebtedness ratio by one to four percentage points depending on the year.

Debts taken on by households from abroad have previously been outside the scope of statistics and the source data for financial accounts have not included data on loans granted by non-resident actors. Foreign loans have grown at a considerable rate in recent years and new data have become available concerning them from the Bank of Finland. This is the first time financial accounts consider households’ indebtedness abroad, which in the second quarter of 2019 amounts to some EUR 2.2 billion. This, in turn, will narrow the difference caused by the methodological revision of the calculation method in households’ indebtedness ratio relative to the previous time series.

Figure 1. Change in financial assets of households, EUR billion

Overall, households’ financial assets amounted to EUR 304 billion at the end of 2018. The growth from 2018 was EUR 1.5 billion. Of these, EUR 92 billion were deposits, EUR 83 billion unquoted shares and equity, EUR 55 billion insurance and pension technical reserves, EUR 33 billion quoted shares, and EUR 23 billion mutual fund shares. The value of other financial assets held by households was EUR 18 billion. Households’ shares in housing corporations are not included in households’ financial assets in the financial accounts but they are part of other assets or real assets.

The growth rate of households’ liabilities continued nearly unchanged. The amount of housing loans and other loan debts grew over the year rising to EUR 150 billion at the end of the year. Households' indebtedness ratio, or the proportion of loan debts relative to their total disposable income in the four latest quarters, rose to 127.2 per cent at the end of 2018.

1.1. General government’s financial position weakened clearly

General government's financial position weakened clearly in 2018. Net financial assets declined to EUR 120.8 billion, which is EUR 9.5 billion less than one year before. The weakened financial position is explained by a decrease in the net financial assets of employment pension schemes that belong to social security funds. Simultaneously, the net financial assets of central government and local government sector also decreased. The net financial assets of other social security funds, in turn, went up.

At the end of the year, the level of central government's net financial assets stood at EUR -67.0 billion, which is EUR 1.7 billion less than at the end of 2017. The decrease in net financial assets is based on a drop in in the deposit stock and an increase in the stock of liabilities.

The net financial position of local government made another downturn during 2018. Net financial assets stood at EUR -4.6 billion at the end of 2018. The weakening of the net financial position was especially affected by a growth in long-term loan debts.

Employment pension schemes had EUR 196.3 billion in financial assets. At the same time, liabilities taken into account in financial accounts amounted to EUR 6.4 billion, so the amount of employment pension schemes’ net financial assets was EUR 190.0 billion. Net financial assets went down by EUR 6.6 billion from the previous year. The main reason for the drop in net financial assets in 2018 was the negative market development in the last quarter. The market value of quoted shares fell throughout the year by EUR 3.9 billion. The corresponding change for mutual fund shares was EUR 2.2 billion negative. EUR 1.4 billion more assets flowed to mutual fund shares. Good one-half of employment pension schemes’ financial assets are tied to fund shares. Employment pension schemes acquired additional quoted shares to the net amount of EUR 1.2 billion. Assets flowed out from deposits to the net amount of EUR 2.3 billion during 2018. The investment flow of debt security investments was negative EUR 1.2 billion and they also generated EUR 0.8 million in holding losses.

The net financial position of other social security funds, in turn, improved by EUR 0.6 billion from the previous year. At the end of 2018, the level of net financial assets was EUR 2.5 billion. The total amount of debt securities issued by other social security funds on the market decreased by EUR 0.3 billion and their investments in debt securities issued by others grew by EUR 0.2 billion.

1.2. Non-financial corporations decreased debt financing

Non-financial corporations' debt financing decreased by slightly over EUR seven billion during 2018. Debt financing refers to the total of loan debts and financing in the form of debt securities. Over the year, non-financial corporations' stock of short-term and long-term debt securities decreased from EUR 249 billion to EUR 241 billion. The reduction came primarily from short- and long-term loans. Here, the non-financial corporations sector does not include housing companies or other housing corporations.

1.3. The six-year growth in domestic mutual funds made a downturn

The growth in domestic mutual funds that had continued for six years made a downturn in 2018. Investment funds contracted by EUR eight billion from the year before. The holding losses of funds explain around EUR seven billion of the annual reduction of assets, even though, there were also clear reductions in quoted shares and fund shares, especially in the third and fourth quarters.

A considerable reorganisation of activities in a major commercial bank that happened in Finland’s deposit bank sector in 2018 explains the majority of the large annual changes in financial institutions’ balance sheet items. As a result of the reorganisation, the size of Finland’s deposit bank sector relative to the entire economy grew and is now among the biggest in a European examination

1.4. Insurance corporations’ liabilities decreased

Insurance corporations’ insurance and pension liabilities decreased by EUR 2.1 billion to EUR 59.8 billion. The drop is explained by a decrease of EUR 2.2 billion in liabilities based on life insurance and annuity. The non-life insurance technical reserve increased by EUR 0.1 billion, while pension liabilities decreased by the same amount in 2018.

Insurance corporations’ financial assets declined from 75.8 billion to EUR 72.1 billion over the year. In particular, investments in mutual funds decreased from EUR 40.8 billion to EUR 38.2 billion. Investments in mutual funds represented 53 per cent of insurance corporations’ financial assets. Insurance corporations held long-term debt securities to the tune of EUR 16.8 billion, which is almost at the same level as one year ago. Deposit assets diminished by EUR 0.7 billion to EUR 3.2 billion.

1.5. Foreign holdings in Finnish quoted shares rose to over 53 per cent

Net investments to Finland by foreign bodies increased by EUR 28 billion in 2018. The main increases were visible in deposits, EUR 11 billion, and in short-and long-term debt securities, EUR 14 billion. Changes in deposit assets and liabilities were mainly linked to operations between resident and non-resident financial institutions. Foreign investors also increased their holdings in quoted shares and mutual fund shares last year. At the end of 2018, the value of foreign share holdings in Finnish quoted shares was EUR 121 billion. The share of foreign ownership of the value of Finnish quoted shares was slightly over 53 per cent having been slightly over 50 per cent in 2017.

At the end of 2018, nearly EUR 750 billion in Finnish domestic sectors’ financial assets were invested abroad. Of foreign investment instruments, particularly deposits, shares and mutual fund shares were favoured by domestic investors in 2018. At the end of the year, Finnish units owned EUR 55 billion worth of foreign quoted shares and EUR 106 billion worth of domestic quoted shares. Finns owned EUR 128 billion in foreign fund shares and the level for domestic fund shares was EUR 94 billion. Net investments in foreign funds amounted to close on EUR three billion but due to holding losses, the stock of foreign mutual fund shares held by Finns remained almost at the same level as in 2017 and stood at EUR 128 billion at the end of 2018.

1.6. Private sector debt decreased

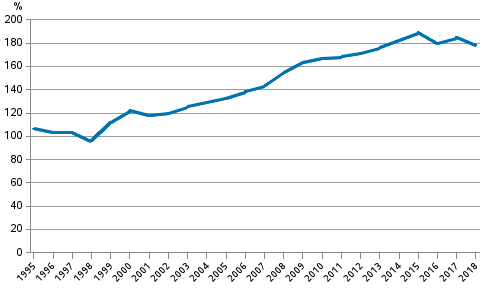

Private sector debt as percentage of GDP decreased by 6.5 percentage points to 178.6 per cent. The level for the total stock was EUR 419 billion at the end of 2018. Private sector debt comprises the loan debts and debts in the form of debt securities of non-financial corporations, households and non-profit institutions serving households.

Figure 2. Non-consolidated private sector debt as percentage of GDP

Source: Financial Accounts, Statistics Finland

Inquiries: Tuomas Koivisto 029 551 3329, Timo Ristim�ki 029 551 2324, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Updated 27.9.2019

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 2018,

1. Utilisation of new data sources lowered households’ indebtedness ratio slightly

. Helsinki: Statistics Finland [referred: 9.3.2026].

Access method: http://stat.fi/til/rtp/2018/rtp_2018_2019-09-27_kat_001_en.html