1. Sector-specific review on the data for the first quarter of 2013

1.1. Households' disposable income has grown slightly

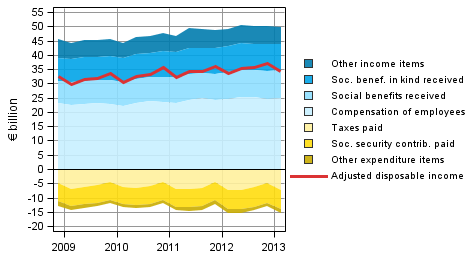

In the first quarter of 2013, the disposable income of households grew by around EUR 0.7 billion, or by nearly three per cent compared to the corresponding quarter in 2012. The key components of disposable income on the income side are wages, salaries, entrepreneurial income and property income and social benefits received. The biggest expense items are taxes paid and social contributions.

Figure 1. Components of household sector adjusted disposable income

Compared to the figures one year ago, disposable income grew mainly due to an increase of good EUR 200 billion in wages and salaries and of EUR 480 billion in social benefits. There were no significant changes in the expense items compared with the corresponding quarter of the previous year. Both interest income and expenses diminished clearly from the corresponding quarter of the year before.

When received social benefits in kind are added to the disposable income of households, the household adjusted disposable income is derived, which is the indicator recommended by the OECD for measuring economic well-being. Social benefits in kind refer to education, health and social services, for example. The adjusted disposable income grew by 2.1 per cent compared to the corresponding quarter last year.

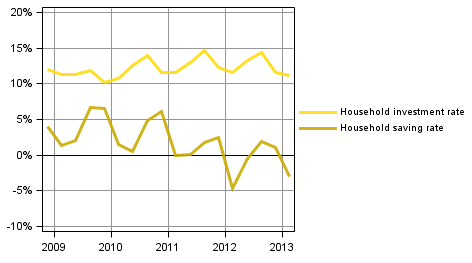

In the first quarter of 2013, households' saving rate was -3 per cent of the disposable income. One year ago, the saving rate was -4.6 per cent. The saving rate is derived by deducting consumption expenditure from disposable income. The saving rate is negative if households' consumption expenditure is higher than their disposable income. In the first quarter of 2013, the investment rate of households accounted for 11.1 per cent of their disposable income. One year ago, the investment rate was 11.6 per cent. Most of households' investments were investments in dwellings.

Figure 2. Households' indicators

Wages and salaries paid by non-profit institutions serving households increased by one per cent compared with the quarter one year ago.

In these statistics, the households sector only covers the actual households sector S14. Sector S15, non-profit institutions serving households is calculated and published separately. In Eurostat’s publications the households sector also includes the data for sector S15. Another difference is in how consumption of fixed capital is taken into account: Eurostat publishes investment and saving rates as gross figures, i.e. including consumption of fixed capital. These statistics use net data, i.e. consumption of fixed capital is removed from the figures.

1.2. Economic downturn lowers profits in the non-financial corporations sector

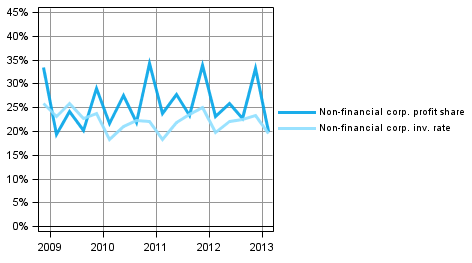

In the first quarter of 2013, the profit share of non-financial corporations, or the share of profits in value added, was 20.0 per cent. One year previously, the corresponding figure was 23.2 per cent. Compared with the figures of one year ago, the profit share of non-financial corporations has been lower for over one year. The profit share is mainly determined based on the development of value added. Compensation of employees develops more evenly, so fluctuations in value added are visible in profits.

Figure 3. Non-financial corporations' indicators

The investment rate of non-financial corporations, or the proportion of fixed capital investments in value added, has also been falling. This trend continued in the current year. In the first quarter of 2013, the investment rate was 19.5 per cent while the corresponding figure was 19.9 per cent one year ago.

The low general level of interest rates still affects the financial and insurance sector. In the first quarter, property income in the sector was 27 per cent lower and property expenditure was 34 per cent lower than in the first quarter of last year. The gross value added of the sector fell by 2.9 per cent from last year and compensation of employees was around one per cent lower than one year ago. Operating surplus, or profits, was slightly over eight per cent lower than the figure one year ago. Holding gains and losses generated through own securities trading are not visible in the value added and operating surplus; they describe the income that is generated from providing financial services to the public.

1.3. Financial position of general government clearly weaker than one year before

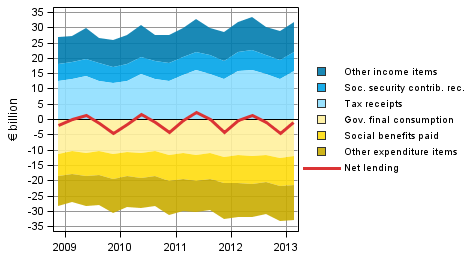

General government unconsolidated total revenue was EUR 0.2 billion higher in the first quarter of the year than a year ago. Total expenditure in turn increased by EUR 0.9 billion. General government is comprised of central government, local government and social security funds. Unconsolidated total revenue and expenditure are figures in which flows between the general government sub-sectors have not been eliminated.

Figure 4. Components of general government sector net lending

The general government deficit (net lending) which is formed as the difference between the total revenue and expenditure, deepened by EUR 0.8 billion. The deficit increased particularly due to the growth of EUR 0.5 billion in social benefits paid. On the income side, total tax revenue was of the same size as in the previous year and property income contracted.

Of the sub-sectors, the deficit of central government and social security funds grew from last year, while the financial position of local government remained nearly unchanged. More detailed statistics of the sector accounts of the general government subsectors are provided in another publication: http://www.stat.fi/til/jtume/index_en.html .

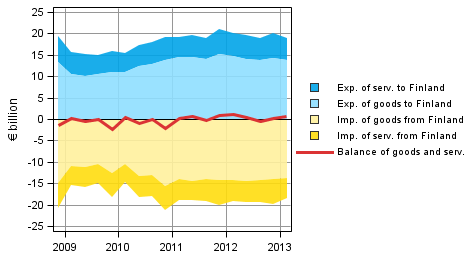

1.4. Deficit in foreign trade lower in the first quarter than one year previously

The essential items for the rest of the world sector are exports and imports of goods and services. Exports of goods and services at current prices abroad from Finland amounted to EUR 18.4 billion in the first quarter of 2013. One year ago, exports at current prices amounted to EUR 19.1 billion. Exports of goods decreased by EUR 0.6 billion and those of services remained unchanged from the corresponding quarter of last year.

Figure 5. Components of the balance of goods and services in foreign trade (from the perspective of the rest-of-the-world sector)

Note: Figures may differ from Bank of Finland's balance of payments figures due to differences in compilation schedules. This regards especially the latest quarters.

Imports to Finland at current prices amounted to EUR 19.0 billion in the first quarter. One year previously, the corresponding figure was EUR 20.2 billion. Imports of goods fell by EUR 1.0 billion and imports of services went down EUR 0.2 billion.

The balance for goods and services, which is the difference between imports and exports, thus showed a deficit of approximately EUR 0.6 billion in the first quarter. One year ago, the deficit was EUR 1.1 billion. The contraction in the deficit of the balance for goods and services was compensated for by other items, such as larger current transfers paid abroad, as a result of which the current account deficit remained at the same level as last year.

1.5. Data and methods used

The quarterly data become revised as source data are updated. The biggest revision will take place for the latest two to three years, because then the data in the annual accounts are still preliminary. The data in the publication are based on the data sources available by 20 June 2013. The data for 1999 to 2012 correspond with the annual sector accounts of the national accounts, although concerning the year 2012, the updating of source data causes small differences to the previous annual accounts data released on 1 March 2013.

The saving rate, profit share and investment rate in the quarterly publication of sector accounts are net amounts, that is, consumption of fixed capital is removed from the figures. The key indicators in these statistics were calculated as follows:

Households' saving rate = B8N / (B6N+D8R)

Households' investment rate = P51K / (B6N+D8R)

Profit share of non-financial corporations = B2N / B1NPH

Investment rate of non-financial corporations = P51K / B1NPH

Source: Sector accounts, Statistics Finland

Inquiries: Jesse Vuorinen 09 1734 3363, Katri Soinne 09 1734 2778, skt.95@stat.fi

Director in charge: Leena Storgårds

Updated 28.6.2013

Official Statistics of Finland (OSF):

Quarterly sector accounts [e-publication].

ISSN=2243-4992. 1st quarter 2013,

1. Sector-specific review on the data for the first quarter of 2013

. Helsinki: Statistics Finland [referred: 27.2.2026].

Access method: http://stat.fi/til/sekn/2013/01/sekn_2013_01_2013-06-28_kat_001_en.html