Published: 17 September 2021

Households' saving rate still declined in the second quarter

Households’ saving rate fell in April to June from the previous quarter. Consumption expenditure grew more strongly than disposable income. Households’ investment rate remained on level with the previous quarter. The profit share of non-financial corporations grew sharply. The growth in the profit share was due to faster relative growth in value added compared to compensation of employees paid. The investment rate of the non-financial corporations sector remained unchanged. These data derive from Statistics Finland’s quarterly sector accounts.

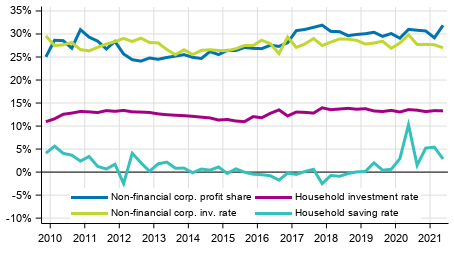

Key indicators for households and non-financial corporations, seasonally adjusted

The key figures were calculated from seasonally adjusted time series. Sector accounts are calculated only at current prices. However, an indicator describing the development adjusted for price changes is calculated for households' adjusted disposable income. The profit share, saving rate and investment rate are calculated from net figures, from which consumption of capital is removed. Households do not include non-profit institutions serving households.

Households

Households’ seasonally adjusted saving rate decreased clearly from the data of the previous quarter and stood at 2.9 per cent in April to June. The saving is derived by deducting consumption expenditure from disposable income. The saving is positive if households' disposable income is greater than households' consumption expenditure. The saving rate refers to the share of households’ savings in disposable income. In the second quarter of 2021, households’ disposable income grew slightly from the previous quarter, but as consumption expenditure grew significantly, being almost on the level prior to the pandemic as a whole, savings and thus the saving rate decreased clearly compared with the previous quarter.

Households’ seasonally adjusted investment rate remained on level with the previous quarter, 13.3 per cent. The investment rate is the ratio of households' investments to disposable income. Most of households' investments are investments in dwellings. Households’ investments remained, in practice, on level with the previous quarter, and as disposable income grew only slightly, the investment rate remained unchanged.

Compared with the corresponding quarter of the previous year, households' disposable income increased by good EUR 500 million in the second quarter of 2021. The key components of disposable income on the income side are wages and salaries received, entrepreneurial and property income, and social benefits received. The biggest expense items are taxes paid and social contributions. In the second quarter of 2021, wages and salaries received grew by EUR 1.9 billion, entrepreneurial income and social benefits received remained on level with the previous year, and property income received decreased slightly compared with the previous year’s figures. On the expense side, taxes paid increased by nearly EUR 600 million and social contributions paid grew by good EUR 800 million compared with the corresponding period of the previous year. The large increase in social security contributions paid was mainly due to the temporary reduction in employers’ pension contributions at the onset of the pandemic, and now the contributions are again on the same level as before.

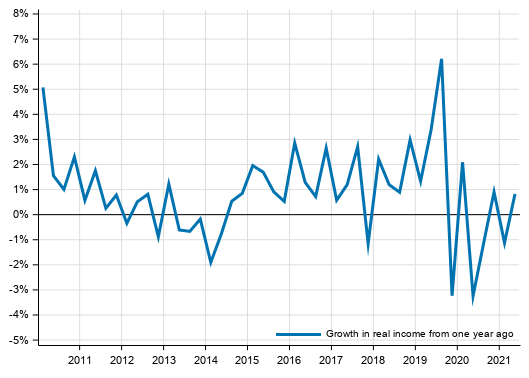

When individual services produced by the public sector and non-profit institutions, such as educational, health and social services, are added to disposable income, the concept of adjusted disposable income can be attained. Adjusted disposable income is the indicator recommended by the OECD for evaluating the economic well-being of households. In the second quarter of 2021, households’ adjusted disposable income grew at current prices by 2.3 per cent and adjusted for price changes by 0.8 per cent from the corresponding quarter of the year before. The indicator describing the development of adjusted disposable income adjusted for price changes can be found in Appendix table 3 of this publication.

Volume development of households’ adjusted disposable income

Compensation of employees paid by non-profit institutions serving households increased by as much as 7.4 per cent compared with the exceptionally low quarter of one year ago. Many associations in the fields of sports and culture have clearly recovered and are starting to operate at pre-pandemic levels.

In these statistics, the households sector only covers the actual households sector S14. Sector S15, non-profit institutions serving households, is calculated and published separately. The households sector in Eurostat’s publications also includes the data for sector S15. Another difference to Eurostat's publication is in how consumption of fixed capital is taken into account. Eurostat publishes investment and saving rates as gross figures, i.e. including consumption of fixed capital. Net data are used in these statistics, that is, when consumption of fixed capital is taken into account, saving and investment rates decrease.

Profit share of non-financial corporations grew from the previous quarter

In the second quarter of 2021, the seasonally adjusted profit share of non-financial corporations grew by 2.7 percentage points to 31.9 per cent. The profit share refers to the share of the operating surplus in value added. The operating surplus is calculated by deducting from value added compensation of employees paid and other taxes on production and by adding to it received subsidies on production. The significant growth in the profit share is explained by the fact that the value added of non-financial corporations has grown more strongly than compensation of employees.

The investment rate of non-financial corporations, or the proportion of fixed capital investments in value added decreased by 0.7 percentage points to 27.0 per cent. Seasonally adjusted investments grew in relative terms more slowly than value added.

Profits of financial and insurance corporations grew

Seasonally adjusted value added in financial and insurance corporations grew by 12.2 per cent from the previous year's corresponding quarter. Output went up by 16.4 per cent and intermediate consumption by 19.9 per cent. The operating surplus describing profits in the sector was EUR 0.7 billion in the second quarter and it grew by 25 per cent. Compensation of employees paid, in turn, grew by 4.8 percentage points from one year ago.

Property income in the sector grew and property expenditure fell from the respective quarter of the year before. The property income of financial and insurance corporations grew by 8.8 per cent, or by around EUR 0.3 billion. Property expenditure was 7.3 per cent, or around EUR 0.2 billion lower than in the corresponding quarter of the year before. Property items include dividends, interests and reinvested earnings. Of income and expenditure items, interest received and paid by monetary financial institutions particularly went down. Financial and insurance corporations paid less dividends but received more than one year earlier.

Value added and operating surplus describe the income that is generated from providing financial services to the public. It does not include property income or holding gains of securities.

Financial position of general government improved from last year

Consolidated total general government revenue grew by EUR 3.4 billion, while consolidated total expenditure remained on level with the previous year's quarter. The difference between revenue and expenditure, that is, the financial position of general government, was EUR 0.5 billion in surplus.

The statistics on quarterly sector accounts examine general government as a whole. More detailed information on quarterly sector accounts of general government can be found in the statistics on general government revenue and expenditure where the sub-sectors are specified: http://www.stat.fi/til/jtume/index_en.html

International trade increased in the second quarter of 2021

Exports of goods from Finland amounted to EUR 16.7 billion in the second quarter of 2021, which was 19.4 per cent more than in the corresponding quarter one year ago. Exports of services amounted to EUR 6.2 billion, which was 9.4 per cent more than one year ago. Imports of goods to Finland amounted to EUR 15.9 billion, which was 22.0 per cent more than one year ago. Imports of services amounted to EUR 6.9 billion, which was 6.9 per cent more than one year ago. The balance of goods and services was nearly in balance in the second quarter of 2021.

Property income received from abroad was around EUR 0.9 billion higher than property income paid abroad. Property income includes dividends, interests and reinvested earnings. Current transfers paid abroad from Finland were around EUR 0.8 billion higher than current transfers paid from abroad to Finland. The most significant current transfer item is the GNI payment paid by the state to the EU. The current account was EUR 0.2 billion in surplus in the second quarter of 2021.

Data and methods used

The quarterly data become revised as source data are updated. The biggest revisions take place for the last two to three years, because the data in the annual accounts are still preliminary. The data in this publication are based on the data sources available by 1 September 2021. The data for 1999 to 2020 mainly correspond with the annual sector accounts of the National Accounts.

The saving rate, profit share and investment rate in the quarterly publication of sector accounts are net amounts, i.e. consumption of fixed capital has been removed from the figures. In addition, financial accounts data on the stock of households’ loan debts are used in calculating households’ indebtedness rate. The indebtedness rate is presented adjusted and non-adjusted for seasonal variation in the database table of sector accounts. The indebtedness rate from figures non-adjusted for seasonal variation is published by financial accounts. The key indicators in these statistics were calculated as follows:

Households' saving rate = B8N / (B6N+D8R)

Households' investment rate = P51K / (B6N+D8R)

Households' indebtedness rate = F4 / B6N

Profit share of non-financial corporations = B2N / B1NPH

Investment rate of non-financial corporations = P51K / B1NPH

The indicator of households' adjusted disposable income is calculated using the price data of the statistics on quarterly national accounts, with which the components of adjusted disposable income are deflated. Households' disposable income is deflated with the implicit price index of household consumption expenditure. Price data are also available for the consumption of non-profit institutions serving households. As a methodological shortcoming, general government individual consumption expenditure has to be deflated with the total general government consumption expenditure for lack of more accurate data. The volume time series was formed with the annual overlap method.

Source: Sector accounts, Statistics Finland

Inquiries: Nata Kivari 029 551 3361, Jarkko Kaunisto 029 551 3551, kansantalous.suhdanteet@stat.fi

Head of Department in charge: Katri Kaaja

Publication in pdf-format (461.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

- Revisions in these statistics

-

- Revisions in these statistics (17.9.2021)

Updated 17.9.2021

Official Statistics of Finland (OSF):

Quarterly sector accounts [e-publication].

ISSN=2243-4992. 2nd quarter 2021. Helsinki: Statistics Finland [referred: 19.2.2026].

Access method: http://stat.fi/til/sekn/2021/02/sekn_2021_02_2021-09-17_tie_001_en.html