Published: 29 September 2017

General government debt decreased slightly in the second quarter of 2017

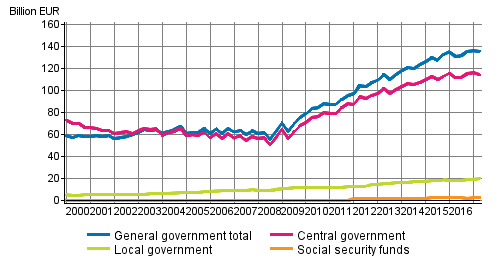

General government EDP debt, or consolidated gross debt at nominal prices, totalled EUR 135.9 billion at the end of the second quarter of 2017. From the previous quarter, debt decreased by EUR 0.4 billion. These data derive from Statistics Finland's statistics on general government debt by quarter.

General government debt by quarter

Central government debt decreased by EUR two billion in the second quarter. The decrease in debt was mainly caused by net amortisations of EUR 4.2 billion in central government bonds. At the end of June, the nominal value of central government bonds in circulation was EUR 98.6 billion. The stock of debt instruments with short maturity periods of under 12 months grew at the same time on net by EUR 2.9 billion and that of transferrable deposits and other deposits by EUR 0.2 billion. In addition, short-term loans decreased by a total of EUR 0.9 billion. The combined debt of the local government sector grew during the second quarter by EUR 0.8 billion mainly as a result of the growing stock of long-term loans. In addition, the stock of short-term and long-term debt securities grew in total by EUR 0.2 billion. The debt of social security funds grew during the second quarter by EUR 0.3 billion due to the growing stock of received cash collateral related to employment pension schemes' derivative contracts and securities lending, which are classified as short-term loans.

General government EDP debt describes general government’s debt to other sectors of the national economy and to the rest of the world, and its development is influenced by changes in unconsolidated debt and internal general government debts. Consolidated general government gross debt is derived by deducting debts between units recorded under general government from unconsolidated gross debt. For this reason, general government debt is smaller than the combined debts of its sub-sectors.

The EDP debt of general government differs conceptionally to some extent in the case of central government, from the central government debt published by the State Treasury. Central government's EDP debt includes loans granted to beneficiary counties by the European Financial Stability Facility EFSF mentioned above, received cash collaterals related to derivative contracts, the capital of the Nuclear Waste Management Fund, debts generated from investments in central government's PPP (public-private partnership) projects, coins that are in circulation, and the deposits of the European Commission. In National Accounts, central government is also a broader concept than the budget and financial economy (http://www.stat.fi/meta/luokitukset/_linkki/julkisyhteisot.html). The valuation principle for both debt concepts is the nominal value, where the effect of currency swaps is taken into account.

Source: General government debt by quarter, Statistics Finland

Inquiries: Timo Ristimäki 029 551 2324, Henna Laasonen 029 551 3303, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (216.1 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Revisions in these statistics

-

- Revisions in these statistics (29.9.2017)

Updated 29.9.2017

Official Statistics of Finland (OSF):

General government debt by quarter [e-publication].

ISSN=1799-8034. 2nd quarter 2017. Helsinki: Statistics Finland [referred: 3.3.2026].

Access method: http://stat.fi/til/jyev/2017/02/jyev_2017_02_2017-09-29_tie_001_en.html