Published: 28 October 2011

Households' net financial assets continued to fall in the second quarter of 2011

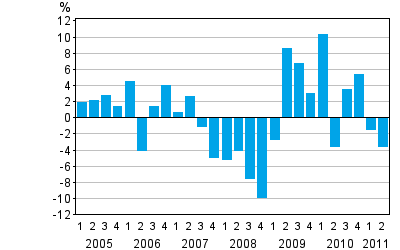

In the second quarter of 2011, households' net financial assets decreased by 3.6 per cent when compared to the previous quarter. This continued the fall that started in the previous quarter. The change was caused by increasing borrowing by households and the fall in share prices. Households’ net financial assets, or the difference between financial assets and liabilities, totalled EUR 98.6 billion at the end of the second quarter of 2011. These data derive from Statistics Finland’s financial accounts statistics.

Change from the previous quarter in households' net financial assets

Households’ debts rose to EUR 123.3 billion in the second quarter of 2011. They grew by EUR 2.4 billion from the previous quarter. At the same time, households’ financial assets went down by EUR 1.3 billion to EUR 221.9 billion. This was so regardless of the fact that deposits in the household sector were again growing strongly. Deposits in the sector increased by EUR 1.9 billion, thus reaching EUR 77.6 billion. The fall in financial assets was due to holding losses of quoted shares, which rose to EUR 2.9 billion along with fallen share prices.

The risen level of interest rates and the uncertain situation in the financial market tempted households to make more deposits. The growth in households’ deposits was equally strong for cash deposits and fixed-term deposits. Cash deposits grew by EUR 1.0 billion to EUR 40.8 billion while fixed-term deposits went up by EUR 0.9 billion to EUR 36.8 billion. Deposits account for 35 per cent of households’ financial assets.

A change connected to housing corporation loans was made to the statistics on quarterly financial accounts. Now households’ share of housing corporation loans is included in households’ loan debts in the quarterly statistics as well. The effect of the transfer is significant, since during the second quarter of 2011 households’ loan debts grew by EUR 7.0 billion because of it. Correspondingly, housing corporations’ loan debts fell by corresponding amounts. The change was made to the entire time series of quarterly financial accounts, which extends to the last quarter of 1997. The new time series on households' debts is available in the StatFin database. Because of the transfer, quarterly data from financial accounts are now in this part congruent with the annual statistics.

As for non-financial corporations’ financial assets, the most significant changes were the EUR 1.9 billion decrease in cash deposits and the holding losses of EUR 1.4 billion concerning particularly quoted shares owned by non-financial corporations. Non-financial corporations’ financial assets went down by EUR 5.3 billion to EUR 300.0 billion. However, non-financial corporations’ debts decreased clearly more than their financial assets. This is almost entirely due to fallen share prices. In the financial accounts, quoted shares are entered at market value and thus fallen share prices reduce non-financial corporations’ debt. While other debt items remained more or less unchanged, the fall in share prices was almost entirely accountable for the decrease of EUR 18.9 billion in non-financial corporations’ financial debts. The difference between non-financial corporations’ financial assets and liabilities, or net financial assets, thus improved by EUR 13.7 billion to EUR -208.9 billion.

Source: Financial accounts, Statistics Finland

Inquiries: Peter Parkkonen (09) 1734 2571, rahoitus.tilinpito@stat.fi

Director in charge: Ari Tyrkkö

Publication in pdf-format (246.4 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 28.10.2011

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 2nd quarter 2011. Helsinki: Statistics Finland [referred: 4.3.2026].

Access method: http://stat.fi/til/rtp/2011/02/rtp_2011_02_2011-10-28_tie_001_en.html