Published: 31 January 2012

Households’ net financial assets in strong decline in the third quarter of 2011

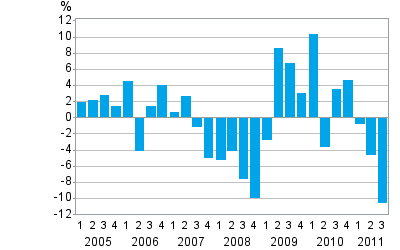

In the third quarter of 2011, households’ net financial assets decreased by EUR 10.3 billion from the previous quarter. A fall of corresponding size was last seen when the financial crisis was peaking in the last quarter of 2008. There were two main underlying reasons for the decline. Households’ borrowing was growing steadily while at the same time share prices continued to fall. Households’ net financial assets, or the difference between financial assets and liabilities, amounted to EUR 87.5 billion at the end of the third quarter of 2011. These data derive from Statistics Finland’s financial accounts statistics.

Change from the previous quarter in households' net financial assets

Households’ debts rose to EUR 124.9 billion in the third quarter of 2011. Their growth from the previous quarter amounted to EUR 1.6 billion. This development follows the steadily rising trend in households' indebtedness that has now persisted for quite some time.

There were significant changes on the side of households’ receivables. The sector’s financial assets fell by a total of EUR 8.7 billion. Holding losses from quoted shares accounted for the lion’s share, or EUR 5.7 billion, of this. The decline in share prices was likewise seen on the side of funds, for it was also the reason for households’ EUR 1.7 billion holding losses from investment fund shares. At the end of the third quarter of 2011, households’ financial assets amounted to EUR 212.3 billion.

The growth in households’ deposits almost came to a standstill on the cash deposits side but continued by EUR one billion on the side of term deposits. Especially due to the overall decline in households’ financial assets, the share of deposits in their financial assets went up by two percentage points to 37 per cent.

The difference between non-financial corporations’ financial assets and liabilities, or net financial assets, improved significantly in the third quarter of 2011. The change amounted to 15.1 per cent, or EUR 31.6 billion. This, too, was largely due to fallen share prices. In the financial accounts, quoted shares are entered at market value and thus fallen share prices reduce non-financial corporations’ debt. Fallen prices of quoted shares accounted for EUR 26.5 billion of the improvement in the net financial assets of non-financial corporations. At the same time, other debt items remained almost unchanged while financial assets grew by EUR 5.0 billion. The growth in financial assets came especially from deposits which increased by EUR 2.4 billion. At the end of the third quarter of 2011, non-financial corporations’ financial assets amounted to EUR -177.6 billion.

Source: Financial accounts, Statistics Finland

Inquiries: Peter Parkkonen (09) 1734 2571, rahoitus.tilinpito@stat.fi

Director in charge: Ari Tyrkkö

Publication in pdf-format (243.4 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 31.1.2012

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 3rd quarter 2011. Helsinki: Statistics Finland [referred: 3.3.2026].

Access method: http://stat.fi/til/rtp/2011/03/rtp_2011_03_2012-01-31_tie_001_en.html