Published: 31 March 2015

Households’ indebtedness ratio was 122.2 per cent at the end of 2014

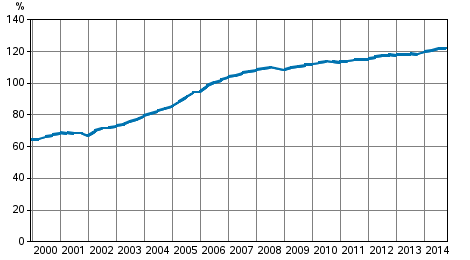

Households’ indebtedness ratio rose to 122.2 per cent in the last quarter of 2014. Indebtedness has grown by 3.7 percentage points from one year ago. These data derive from Statistics Finland’s financial accounts statistics.

Households’ indebtedness ratio

During the fourth quarter of 2014, households' loan debts increased by EUR 0.8 billion to EUR 132.3 billion. Households' disposable income also grew, but in relative terms less. As a result of these changes, households' indebtedness ratio increased to 122.2 per cent. The indebtedness ratio went up by 0.5 percentage points from the previous quarter. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

At the end of 2014, households had a total of EUR 259.6 billion in financial assets and EUR 141.3 billion in debts. During the last quarter, financial assets grew by EUR 1.2 billion and debts by EUR 0.1 billion. As a result of these changes, households' net financial assets increased to EUR 118.3 billion at the end of the quarter.

During the fourth quarter, households' net investments amounted to EUR -0.3 billion. Despite this, households' financial assets increased thanks to holding gains. Households withdrew assets from quoted shares and debt securities. The popularity of mutual funds continued, however, and households' net investments in mutual fund shares was EUR 0.3 billion. The shift within deposits from fixed-term deposits to cash deposits continued.

Non-financial corporations' debt financing grew by EUR 0.6 billion in the last quarter. Non-financial corporations had EUR 170.3 billion in loan debt and EUR 33.5 billion debt in the form of debt securities. Debt financing refers to the total of loan debts and financing in the form of debt securities.

Source: Financial accounts, Statistics Finland

Inquiries: Saara Roine 029 551 2922, rahoitus.tilinpito@stat.fi

Director in charge: Leena Storgårds

Publication in pdf-format (245.4 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 31.3.2015

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 4th quarter 2014. Helsinki: Statistics Finland [referred: 23.2.2026].

Access method: http://stat.fi/til/rtp/2014/04/rtp_2014_04_2015-03-31_tie_001_en.html