Published: 9 July 2015

Growth in households’ assets rested on holding gains in 2014

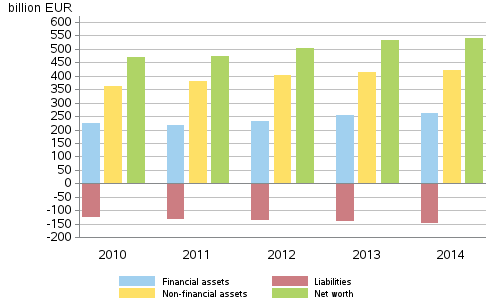

Households' financial assets stood at EUR 262 billion and other assets at EUR 420 billion at the end of 2014. The increase in financial assets was EUR 7 billion during the year and EUR five billion in non-financial assets. The most important items in non-financial assets are buildings and land. Households' debts also grew. The increase amounted to EUR five billion while the level rose to EUR 142 billion. Households' financial assets calculated as the total of financial assets and liabilities and non-financial assets amounted to EUR 540 billion at the end of 2014. The growth from 2013 amounted to EUR 7 billion. A majority of this was generated from holding gains on financial assets. The data appear from Statistics Finland's financial accounts statistics.

Households’ financial assets and liabilities, non-financial assets and net worth 2010–2014, EUR billion

Households’ investment in financial assets declining

Households' net investments in financial assets were close on EUR one million negative. Even though indebtedness also continued to grow, favourable stock market price development and an increase in other assets ensured that households' total assets improved also in 2014. This happened despite the fact that the amount of holding gains was halved from 2013. Households received EUR eight billion in holding gains in 2014. Holding gains were generated in particular from quoted shares and fund shares.

In terms of financial assets, there were shifts between various financial instruments. The popularity of cash deposits continued growing at the expense of fixed-term deposits also in 2014. In 2014, a similar shift also took place from quoted shares to fund shares.

Despite the growth in quoted shares and fund shares, deposits still remain the most important financial asset for households. The share of deposits of all households' financial assets stood at 30 per cent at year-end.

Indebtedness grew

Households' loan debts stood at over EUR 132 billion at the end of 2014. Households’ loan debts grew by EUR 4.7 billion during 2014. This boosted households' indebtedness by 3.7 percentage points to 121.7 per cent. Households' indebtedness is calculated as the ratio of their loan debts at the end of the year to their total disposable income of the year.

Source: Financial Accounts, Statistics Finland

Inquiries: Peter Parkkonen 029 551 2571, rahoitus.tilinpito@stat.fi

Deputy director in charge: Mari Ylä-Jarkko

Publication in pdf-format (391.9 kB)

- Reviews

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Financial assets of households, million EUR (9.7.2015)

- Appendix table 2. Financial liabilities of households, million EUR (9.7.2015)

- Appendix table 3. Household net acquistion of financial assets, million EUR (9.7.2015)

- Appendix table 4. Household net incurrence of liabilities, million EUR (9.7.2015)

- Appendix table 5. Financial assets of non-financial corporations, million EUR (9.7.2015)

- Appendix table 6. Financial liabilities of non-financial corporations, million EUR (9.7.2015)

- Appendix table 7. Net financial assets by sector, million EUR (9.7.2015)

- Appendix table 8. Net financial transactions by sector, million EUR (9.7.2015)

- Appendix table 9. Statistical discrepancy by sector, million EUR (9.7.2015)

- Appendix table 10. Total assets by sector in 2014, billion EUR (9.7.2015)

- Figures

-

- Appendix figure 1. Financial assets of households (9.7.2015)

- Appendix figure 2. Change in financial assets of households (9.7.2015)

- Appendix figure 3. Households net acquisitions of deposits, quoted shares and mutual funds (9.7.2015)

- Appendix figure 4. Net emissions of quoted shares by non-financial corporations (9.7.2015)

- Appendix figure 5. Households indebtedness ratio (9.7.2015)

- Appendix figure 6. Private sector debt as percentage of GDP (9.7.2015)

- Appendix figure 7. Households financial assets and liabilities, non-financial assets and net worth (9.7.2015)

Updated 9.7.2014

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 2014. Helsinki: Statistics Finland [referred: 4.3.2026].

Access method: http://stat.fi/til/rtp/2014/rtp_2014_2015-07-09_tie_001_en.html