Published: 29 June 2017

Growth of households’ net financial assets continued in January to March

Households’ financial assets amounted to EUR 296.8 billion at the end of the first quarter of 2017. The financial assets grew by EUR 3.3 billion during the quarter. Households had EUR 156.2 billion in debt which was EUR 1.6 billion up from the previous quarter. The difference between households’ financial assets and liabilities grew by EUR 1.7 billion to EUR 140.6 billion. The growth in net financial assets has continued for four quarters. These data appear from Statistics Finland's financial accounts statistics.

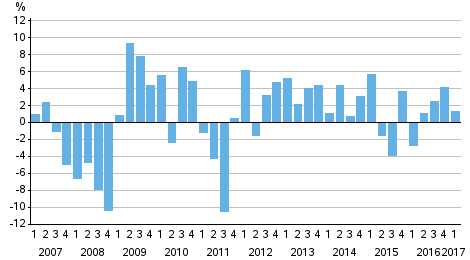

Change from the previous quarter in households net financial assets

Price rise continued to boost households’ financial assets

In the first quarter of 2017, households withdrew EUR 0.2 billion more investments from financial assets than they made new investments. Investments in bonds and other debt securities decreased by EUR one billion on net. The drop was offset by the positive net flow in quoted shares and mutual funds.

Even though the investment flow was slightly negative, the value of financial assets held by households increased from the previous quarter due to holding gains. They amounted to a total of EUR 2.7 billion mainly from shares and mutual fund shares.

Slight growth in households’ loan debts

At the end of the quarter, households had EUR 143.2 billion in loan debt. The amount of loan debt increased by EUR 0.6 billion from the level at year end. The majority of the change was caused by a growth in housing companies’ loan shares attributable to households just like in the previous quarter.

Households’ indebtedness ratio grew by 0.2 percentage points from the previous quarter to 127.1 per cent. At that point, it dropped by as much, so no new record was reached this time. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

Non-financial corporations’ debt financing rose moderately

In the first quarter of 2017, non-financial corporations’ debt financing grew to EUR 220.6 billion after the dip in the previous quarter. The amount of debt financing is still below the level seen a few years back despite the EUR 3.2 billion growth over the quarter. Non-financial corporations’ loan debt went up by EUR 3.5 billion and amounted to EUR 191.2 billion. Non-financial corporations’ financing in the form of debt securities declined by EUR 0.3 billion to EUR 29.4 billion. Debt financing refers to the total of loan debts and financing in the form of debt securities. Here, the enterprise sector has been limited so that it does not include financial and insurance corporations nor housing companies or other housing corporations.

Source: Financial accounts, Statistics Finland

Inquiries: Henna Laasonen 029 551 3303, Peter Parkkonen 029 551 2571, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (247.4 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

- Revisions in these statistics

-

- Revisions in these statistics (29.6.2017)

Updated 29.6.2017

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 1st quarter 2017. Helsinki: Statistics Finland [referred: 7.3.2026].

Access method: http://stat.fi/til/rtp/2017/01/rtp_2017_01_2017-06-29_tie_001_en.html