Published: 16 March 2020

Saving rate of the household sector grew in the last quarter of 2019

Households’ saving rate grew in October to December from the previous quarter. The saving rate turned positive, because disposable income was bigger than consumption expenditure. Households’ investment rate fell slightly below the level of the previous quarter. The profit share of the non-financial corporations sector fell, because the sector's value added contracted at the same time as paid compensations of employees grew. The investment rate of the non-financial corporations sector remained almost on level with the previous quarter. These data derive from Statistics Finland’s quarterly sector accounts.

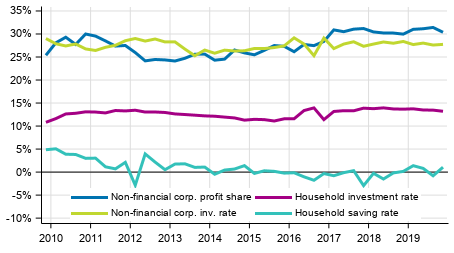

Key indicators for households and non-financial corporations, seasonally adjusted

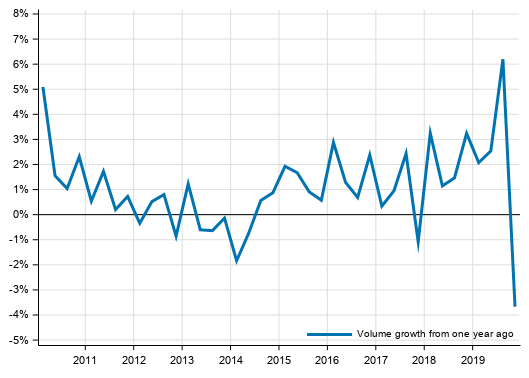

Households' saving rate calculated from seasonally adjusted data grew by 1.9 percentage points to 1.1 per cent in October to December. The saving rate refers to the share of households’ savings in disposable income. Households’ investment rate fell slightly, being 13.2 per cent. Most of households' investments were investments in dwellings. Households' adjusted disposable income calculated from current price data adjusted for price changes decreased by 3.7 per cent from the corresponding quarter in 2018. The drop in both disposable income (value change -3.8 per cent from one year back) and adjusted disposable income is particularly due to a change in the tax refund policy so that the payment of tax refunds started gradually starting from July. Most of the wage and salary earners received their tax refunds already in August or September while tax refunds were earlier paid to everybody in December. However, the corresponding change is not visible in seasonally adjusted data, because it is a question of seasonal variation. Adjusted disposable income is derived by adding individual services produced by the public sector, such as education, health and social services, to the disposable income of households. Adjusted income is the indicator recommended by the OECD for evaluating the economic well-being of households.

Volume development of households’ adjusted disposable income

Data on households’ indebtedness rate were added to the key figure tables of quarterly sector accounts. In calculating the indebtedness rate, use is made of financial accounts data on the stock of households’ loan debts and currently total disposable income of four quarters. The indebtedness rate is calculated both adjusted and non-adjusted for seasonal variation. In the last quarter of 2019, households’ seasonally adjusted indebtedness rate was 128.9 per cent.

In the last quarter of 2019, the profit share of non-financial corporations, or the share of profits in value added, fell from the previous quarter by one percentage points to 30.4 per cent. The fall is due to decreased value added and increased paid compensations of employees. The investment rate of non-financial corporations, or the proportion of investments in value added, was 27.7 per cent, while it was 27.6 per cent in the third quarter of 2019. The revised annual accounts figures for the non-financial corporations sector for 2018 also updated the profit share and investment rate of the non-financial corporations sector. The profit shares of the quarters of 2018 were revised downwards and investment rates upwards.

Net lending describing the financial surplus or deficit was EUR 6.6 billion in the non-financial corporations sector calculated from figures non-adjusted for seasonal variation. Compared to the quarter of the previous year, net lending improved by nearly EUR one billion. The growth in net lending is mostly explained by a reduction in inventories.

The key figures were calculated from seasonally adjusted time series. Sector accounts are calculated only at current prices. However, a volume indicator describing the development adjusted for price changes is calculated for households' adjusted disposable income in a separate Appendix table. The profit share, saving rate and investment rate are calculated from net figures, which means that consumption of fixed capital is taken into account. Households do not include non-profit institutions serving households.

Data and methods used

The quarterly data become revised as source data are updated. The biggest revisions take place for the last two to three years, because the data in the annual accounts are still preliminary. Examined by quarter, the biggest revisions occur in the release for the second quarter at the turn of September and October and in the release for the fourth quarter at the turn of March and April. These revisions are caused by updated annual national accounts data. The data in the publication are based on the data sources available by 6 March 2020. The data for 1999 to 2019 mainly correspond with the annual sector accounts of the National Accounts.

The saving rate, profit share and investment rate in the quarterly publication of sector accounts are net amounts, i.e. consumption of fixed capital has been removed from the figures. In addition, financial accounts data on the stock of households’ loan debts are used in calculating households’ indebtedness rate. The indebtedness rate is presented adjusted and non-adjusted for seasonal variation in the database table of sector accounts. In seasonally adjusted figures, both households’ loan stock and disposable income are adjusted for seasonal variation. The indebtedness rate from figures non-adjusted for seasonal variation is published by financial accounts. The key indicators in these statistics were calculated as follows:

Households' saving rate = B8N / (B6N+D8R)

Households' investment rate = P51K / (B6N+D8R)

Households' indebtedness rate = F4 / B6N

Profit share of non-financial corporations = B2N / B1NPH

Investment rate of non-financial corporations = P51K / B1NPH

The volume indicator, measuring the development of households' adjusted disposable income, adjusted for price changes and its change percentages can be found in Appendix table 3 of this publication. This volume indicator is calculated using the price data of the statistics on quarterly national accounts, with which the components of adjusted disposable income are deflated. Households' disposable income is deflated with the implicit price index of household consumption expenditure. Price data are also available for the consumption of non-profit institutions serving households. As a methodological shortcoming, general government individual consumption expenditure has to be deflated with the total general government consumption expenditure for lack of more accurate data. The volume time series was formed with the annual overlap method.

Source: Sector accounts, Statistics Finland

Inquiries: Jarkko Kaunisto 029 551 3551, Katri Soinne 029 551 2778, kansantalous.suhdanteet@stat.fi

Director in charge: Jan Nokkala

Publication in pdf-format (431.3 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

- Revisions in these statistics

-

- Revisions in these statistics (16.3.2020)

Updated 16.3.2020

Official Statistics of Finland (OSF):

Quarterly sector accounts [e-publication].

ISSN=2243-4992. 4th quarter 2019. Helsinki: Statistics Finland [referred: 22.2.2026].

Access method: http://stat.fi/til/sekn/2019/04/sekn_2019_04_2020-03-16_tie_001_en.html