This set of statistics has been discontinued.

New data are no longer produced from the statistics.

Published: 11 October 2019

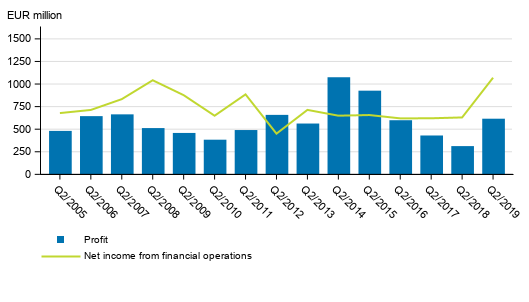

Operating profit of banks operating in Finland was EUR 616 million in the second quarter of 2019

In the second quarter of 2019, the net income from financial operations of credit institutions engaged in banking in Finland amounted to EUR 1,069 million and their operating profit to EUR 616 million. Finland’s bank sector grew as the result of a significant company restructuring in the fourth quarter of 2018, which means that the data in this release are not fully comparable with previous releases. These data derive from Statistics Finland’s financial statement statistics on credit institutions.

Net income from financial operations and operating profit of banks operating in Finland, 2nd quarter 2005 to 2019, EUR million

Interest income and expenses

In the second quarter of 2019, credit institutions engaged in banking in Finland accumulated EUR 1,397 million in interest income. Their interest expenses, in turn, amounted to EUR 327 million. The net income from financial operations calculated as the difference between these was EUR 1,069 million. Compared to the respective quarter in 2018, net income from financial operations of Finnish commercial banks increased considerably. In terms of foreign banks, their net income from financial operations decreased compared to the same quarter in the year before. This was significantly affected by the company restructuring made in the Finnish banking sector in the fourth quarter of 2018.

Administrative expenses

Administrative expenses are a significant expense item for banks operating in Finland. Banks’ administrative expenses amounted to EUR 1.3 billion in the second quarter. Compared to the corresponding quarter last year, administrative expenses increased by EUR 514 million. The share of wages and salaries in administrative expenses grew to 65.3 per cent, while they had been 50.7 per cent in the first quarter of 2019. Because of a significant company restructuring, the administrative expenses after the fourth quarter of 2018 are not really comparable with earlier quarters

Operating profit

The operating profit, or profit from continuing operations before taxes, was EUR 616 million in the second quarter of 2019. Compared to the corresponding quarter in 2018, the operating profit is almost double. The operating profit grew particularly due to interest and commission income. Because of a significant company restructuring, the operating profit after the fourth quarter of 2018 is not really comparable with the operating profit of earlier quarters.

Balance sheet

The aggregate value of the balance sheets of banks was some EUR 717 billion. Of this, the share of equity was around EUR 43 billion which is, on average, six per cent of the balance sheet total. Cooperative banks belonging to OP Financial Group had the biggest share of equity in the balance sheet, around 12.2 per cent. Foreign banks, in turn, had the lowest share of equity in the balance sheet, around 0.4 per cent. On average, the share of equity in the aggregate of the balance sheets for all banks operating in Finland rose by 1.8 percentage points from one year back. The large company restructuring made in the Finnish banking sector in the fourth quarter of 2018 had a considerable effect on banks’ balance sheet total and own equity.

Source: Credit institutions' annual accounts, Statistics Finland

Inquiries: Jukka-Pekka Pyylampi 029 551 3002, Antti Suutari 029 551 3257, rahoitusmarkkinat@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (269.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 11.10.2019

Official Statistics of Finland (OSF):

Financial statement statistics on credit institutions [e-publication].

ISSN=2342-5180. 2nd quarter 2019. Helsinki: Statistics Finland [referred: 22.2.2026].

Access method: http://stat.fi/til/llai/2019/02/llai_2019_02_2019-10-11_tie_001_en.html