Published: 28 September 2018

Households’ net assets grew by EUR 14 billion in 2017

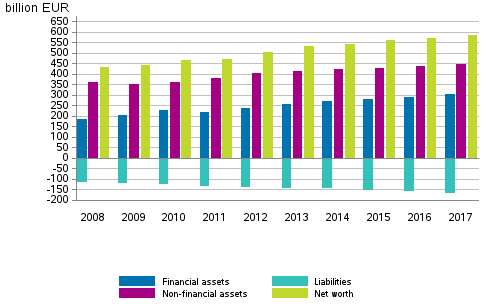

Households’ financial assets amounted to EUR 302 billion and other assets to EUR 445 billion at the end of 2017. Financial assets increased by EUR 12 billion during the year and other assets by EUR nine billion. The most important items in other assets, that is, non-financial assets, are residential buildings and land. Households’ liabilities also grew, in total by EUR seven billion, so the level of liabilities rose to EUR 163 billion. When liabilities are deducted from financial assets and other assets, households’ net assets are EUR 585 billion. Net assets grew by EUR 14 billion or 2.5 per cent year-on-year. A majority of this growth, EUR eight billion was generated by holding gains from financial assets. These data appear from Statistics Finland's financial accounts statistics.

Households’ financial assets and liabilities, non-financial assets and net worth 2008–2017, EUR billion

Households’ net assets have grown for nine years in a row

Households’ net assets have grown continuously for nine years after the drop in 2018. In 2017, the level of net assets, EUR 585 billion, is EUR 151 billion higher than in 2008. In 2017, EUR 14 billion more net assets were accumulated.

The development has been affected by the growth in both financial assets and non-financial assets. In 2017, total assets grew particularly due to the value increase of residential buildings and the favourable value development of share investments. Households’ debt load has also grown every year, but financial and non-financial assets have grown faster than indebtedness.

Deposits still continue as the biggest individual financial investment instrument. Despite low interest rates, the amount of households’ deposits grew by nearly EUR three billion during 2017. At the end of 2017, households’ financial assets amounted to EUR 86 billion in deposits. This corresponded to over 28 per cent of households’ all financial assets. As in previous years, households withdrew their assets from fixed-term deposits at the same time as transferable deposits increased.

The total value of quoted shares and mutual fund shares held by households was EUR 62 billion or around 21 per cent of households’ financial assets. The growth from the end of the previous year amounted to EUR five billion. EUR three billion of the growth came from holding gains and EUR two billion from net additional investments.

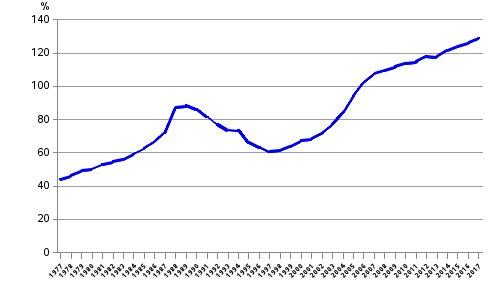

Households’ indebtedness ratio rose by 2.6 percentage points

Households' indebtedness ratio has risen annually nearly continuously since 1997. The indebtedness ratio also grew in 2017 as housing loans and other loan debts increased by EUR six billion. Households’ loan debts amounted to EUR 148 billion at the end of 2017. The growth in loan debts raised households' indebtedness ratio by 2.6 percentage points over the year to 128.9 per cent. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of the year to their total disposable income in the whole year.

Households’ indebtedness ratio 1977 to 2017, loan debt in proportion to disposable income

Source: Financial Accounts, Statistics Finland

Inquiries: Henna Laasonen 029 551 3303, Timo Ristimäki 029 551 2324, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (379.7 kB)

- Reviews

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Financial assets of households, million EUR (28.9.2018)

- Appendix table 2. Financial liabilities of households, million EUR (28.9.2018)

- Appendix table 3. Households´ net acquistion of financial assets, million EUR (28.9.2018)

- Appendix table 4. Households´ net incurrence of liabilities, million EUR (28.9.2018)

- Appendix table 5. Financial assets of non-financial corporations, excl. housing corporations, million EUR (28.9.2018)

- Appendix table 6. Financial liabilities of non-financial corporations, excl. housing corporations, million EUR (28.9.2018)

- Appendix table 7. Net financial assets by sector, million EUR (28.9.2018)

- Appendix table 8. Net financial transactions by sector, million EUR (28.9.2018)

- Appendix table 9. Statistical discrepancy by sector, million EUR (28.9.2018)

- Appendix table 10. Total assets by sector in 2017, billion EUR (28.9.2018)

- Figures

-

- Appendix figure 1. Financial assets of households (28.9.2018)

- Appendix figure 2. Change in financial assets of households (28.9.2018)

- Appendix figure 3. Households net acquisitions of deposits, quoted shares and mutual funds (28.9.2018)

- Appendix figure 4. Households indebtedness ratio (28.9.2018)

- Appendix figure 5. Private sector debt as percentage of GDP (28.9.2018)

Updated 28.9.2018

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 2017. Helsinki: Statistics Finland [referred: 9.3.2026].

Access method: http://stat.fi/til/rtp/2017/rtp_2017_2018-09-28_tie_001_en.html